Business, 06.05.2020 03:25 sharperenae9533

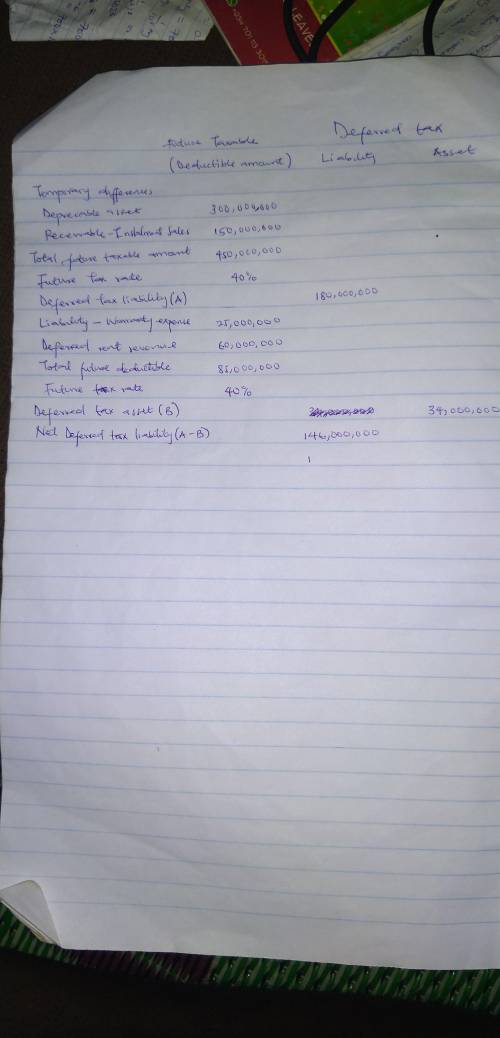

At December 31, DePaul Corporation had a $34 million balance in its deferred tax asset account and a $180 million balance in its deferred tax liability account.

The balances were due to the following cumulative temporary differences:

a. Estimated warranty expense, $25 million: expense recorded in the year of the sale; tax-deductible when paid (one-year warranty).

b. Depreciation expense, $300 million: straight-line in the income statement; MACRS on the tax return.

c. Income from installment sales of properties, $150 million: income recorded in the year of the sale; taxable when received equally over the next five years.

d. Rent revenue collected in advance, $60 million; taxable in the year collected; recorded as income when the performance obligation is satisfied in the following year.

Required:

1. Assuming DePaul will show a single noncurrent net amount in its December 31 balance sheet, indicate that amount and whether it is a net deferred tax asset or liability. The tax rate is 40%.

2. Determine the deferred tax amounts to be reported in the December 31 balance sheet. The tax rate is 40%. (Enter your answers in millions.)

Answers: 1

Another question on Business

Business, 21.06.2019 16:30

Kevin comes across people from various cultures in his job.kevin should deal with people from other cultures with blank . he should communicate by actively

Answers: 3

Business, 21.06.2019 19:20

You wish to buy a cabin in 15 years. today, the cabin costs $150,000. you believe the price of the cabin will inflate at 4% annually. you want to invest a single amount of money (lump sum) today and have the money grow to equal the future purchase price of the cabin 15 years from now. if you can earn 10% annually on your investments, how much do you need to invest now, in order to be able to purchase the cabin?

Answers: 3

Business, 21.06.2019 21:30

Which of the following statements is true regarding the definition of a fund? a fund is a fiscal entity which is designed to provide reporting that demonstrates conformance with finance-related legal and contractual provisions separately from gaap reporting. a fund exists to assist in carrying on activities and attaining objectives where there are no specific rules or restrictions. a fund is an accounting entity which is designed to enable reporting in conformity with gaap without being restricted by legal or contractual provisions. a fund is a mechanism developed to provide accounting for revenues and expenditures that are subject to certain restrictions separate from revenues and expenditures that are not subject to restrictions.

Answers: 1

Business, 21.06.2019 23:00

Ajustification for job training programs is that they improve worker productivity. suppose that you are asked to evaluate whether more job training makes workers more productive. however, rather than having data on individual workers, you have access to data on manufacturing firms in ohio. in particu- lar, for each firm, you have information on hours of job training per worker (training) and number of nondefective items produced per worker hour (output). (i) carefully state the ceteris paribus thought experiment underlying this policy question. (ii) does it seem likely that a firm’s decision to train its workers will be independent of worker characteristics? what are some of those measurable and unmeasurable worker characteristics? (iii) name a factor other than worker characteristics that can affect worker productivity. (iv) if you find a positive correlation between output and training, would you have convincingly established that job training makes workers more productive? explain.

Answers: 2

You know the right answer?

At December 31, DePaul Corporation had a $34 million balance in its deferred tax asset account and a...

Questions

Arts, 28.08.2020 02:01

Mathematics, 28.08.2020 02:01

Social Studies, 28.08.2020 02:01

Mathematics, 28.08.2020 02:01

Biology, 28.08.2020 02:01

Biology, 28.08.2020 02:01

Spanish, 28.08.2020 02:01

Mathematics, 28.08.2020 02:01

Mathematics, 28.08.2020 02:01

History, 28.08.2020 02:01

English, 28.08.2020 02:01

Mathematics, 28.08.2020 02:01

Mathematics, 28.08.2020 02:01

English, 28.08.2020 02:01