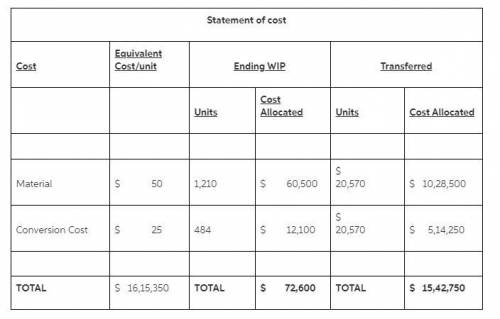

The Blending Department of Luongo Company has the following cost and production data for the month of April. Costs: Work in process, April 1 Direct materials: 100% complete $121,000 Conversion costs: 20% complete 84,700 Cost of work in process, April 1 $205,700 Costs incurred during production in April Direct materials $968,000 Conversion costs 441,650 Costs incurred in April $1,409,650 Units transferred out totaled 20,570. Ending work in process was 1,210 units that are 100% complete as to materials and 40% complete as to conversion costs.

Answers: 1

Another question on Business

Business, 22.06.2019 13:40

Randall's, inc. has 20,000 shares of stock outstanding with a par value of $1.00 per share. the market value is $12 per share. the balance sheet shows $42,000 in the capital in excess of par account, $20,000 in the common stock account, and $50,500 in the retained earnings account. the firm just announced a 5 percent (small) stock dividend. what will the balance in the retained earnings account be after the dividend?

Answers: 1

Business, 22.06.2019 13:40

Determine if the following statements are true or false. an increase in government spending can crowd out private investment. an improvement in the budget balance increases the demand for financial capital. an increase in private consumption may crowd out private investment. lower interest rates can lead to private investment being crowded out. a trade balance in sur+ increases the supply of financial capital. if private savings is equal to private investment, then there is neither a budget sur+ nor a budget deficit.

Answers: 1

Business, 22.06.2019 16:30

Which of the following has the largest impact on opportunity cost

Answers: 2

Business, 22.06.2019 19:20

Garrett is an executive vice president at samm hardware. he researches a proposal by a larger company, maximum hardware, to combine the two companies. by analyzing past performance, conducting focus groups, and interviewing maximum employees, garrett concludes that maximum has poor profit margins, sells shoddy merchandise, and treats customers poorly. what actions should garrett and samm hardware take? a. turn down the acquisition offer and prepare to resist a hostile takeover. b. attempt a friendly merger and use managerial hubris to improve results at maximum. c. welcome the acquisition and use knowledge transfer to impart sam hardware's management practices. d. do nothing; the two companies cannot combine without samm hardware's explicit consent.

Answers: 1

You know the right answer?

The Blending Department of Luongo Company has the following cost and production data for the month o...

Questions

Mathematics, 07.12.2020 14:00

Mathematics, 07.12.2020 14:00

Chemistry, 07.12.2020 14:00

Computers and Technology, 07.12.2020 14:00

History, 07.12.2020 14:00

Mathematics, 07.12.2020 14:00

Mathematics, 07.12.2020 14:00

Health, 07.12.2020 14:00

Biology, 07.12.2020 14:00

Mathematics, 07.12.2020 14:00

Mathematics, 07.12.2020 14:00