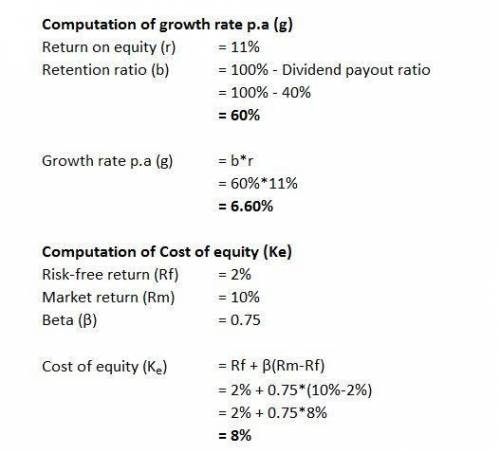

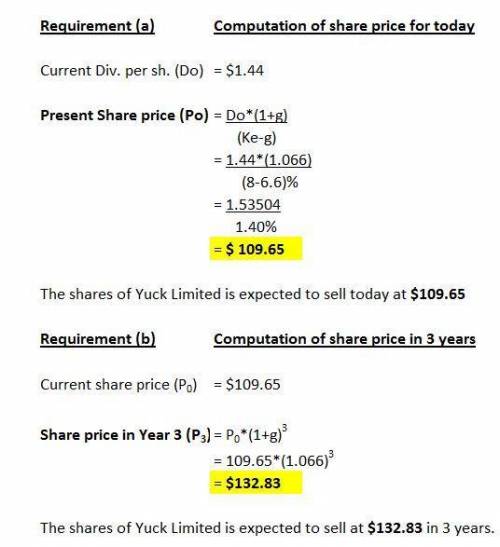

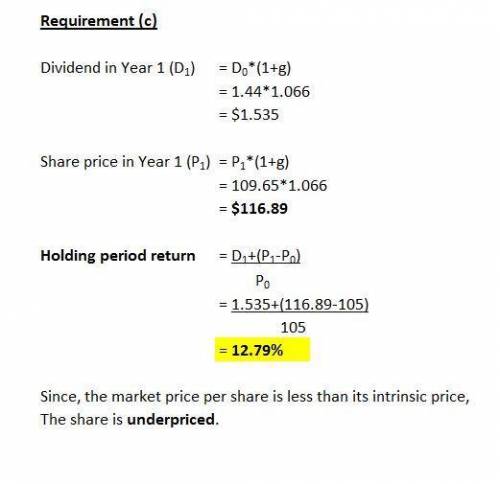

Suppose YUCK! (YUCK), the parent company of many fast food chains that compete with McDonalds, currently has a dividend payout ratio of 40%. Its beta is 0.75 and its current dividend per share is $1.44 per year. Suppose YUCK has a return on equity of 11% and the risk-free rate is 2% while the expected annual return on the S&P 500 is 10%.

(a) At what price do you expect a share of YUCK to sell for today?

(b) At what price do you expect YUCK to sell in three years?

(c) It turns out that YUCK currently sells for $105. If you expect that YUCK’s market price will equal its intrinsic value 1 year from now, what is your expected 1 year holding period return on YUCK stock? What does this imply about under/overpricing and alphas?

Answers: 2

Another question on Business

Business, 22.06.2019 02:00

Answer the following questions using the information below: southwestern college is planning to hold a fund raising banquet at one of the local country clubs. it has two options for the banquet: option one: crestview country club a. fixed rental cost of $1,000 b. $12 per person for food option two: tallgrass country club a. fixed rental cost of $3,000 b. $8.00 per person for food southwestern college has budgeted $1,800 for administrative and marketing expenses. it plans to hire a band which will cost another $800. tickets are expected to be $30 per person. local business supporters will donate any other items required for the event. which option has the lowest breakeven point?

Answers: 1

Business, 22.06.2019 07:30

Which of the following is an example of an unsought good? a. cameron purchases a new bike. b. jordan buys paper towels. c. taylor buys cupcakes from her favorite bakery. d. riley buys new windshield wipers for her car.

Answers: 3

Business, 22.06.2019 11:00

If the guide wprds on the page are "crochet " and "crossbones", which words would not be on the page. criticize, crocodile,croquet,crouch,crocus.

Answers: 1

Business, 22.06.2019 20:20

Xinhong company is considering replacing one of its manufacturing machines. the machine has a book value of $39,000 and a remaining useful life of 5 years, at which time its salvage value will be zero. it has a current market value of $49,000. variable manufacturing costs are $33,300 per year for this machine. information on two alternative replacement machines follows. alternative a alternative b cost $ 115,000 $ 117,000 variable manufacturing costs per year 22,900 10,100 1. calculate the total change in net income if alternative a and b is adopted. 2. should xinhong keep or replace its manufacturing machine

Answers: 1

You know the right answer?

Suppose YUCK! (YUCK), the parent company of many fast food chains that compete with McDonalds, curre...

Questions

Biology, 04.10.2021 14:00

English, 04.10.2021 14:00

Mathematics, 04.10.2021 14:00

Mathematics, 04.10.2021 14:00

Health, 04.10.2021 14:00

Chemistry, 04.10.2021 14:00

Physics, 04.10.2021 14:00

Mathematics, 04.10.2021 14:00

Computers and Technology, 04.10.2021 14:00

Mathematics, 04.10.2021 14:00

Mathematics, 04.10.2021 14:00

Mathematics, 04.10.2021 14:00