Business, 26.04.2020 01:15 batmandillon21

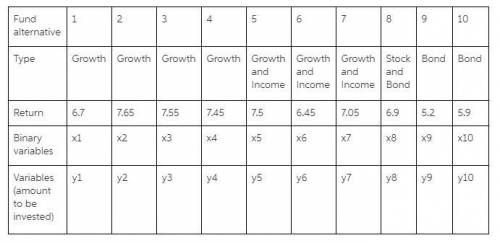

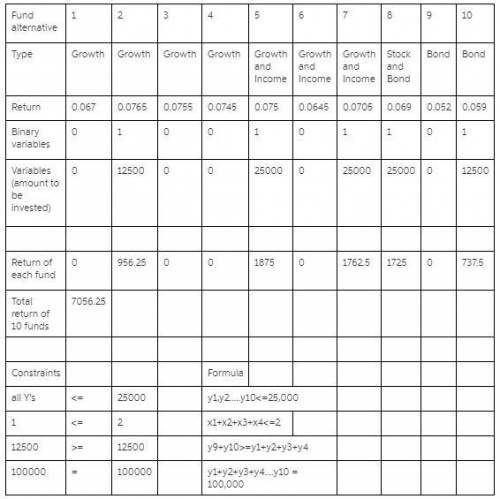

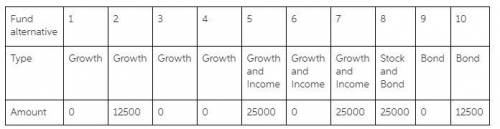

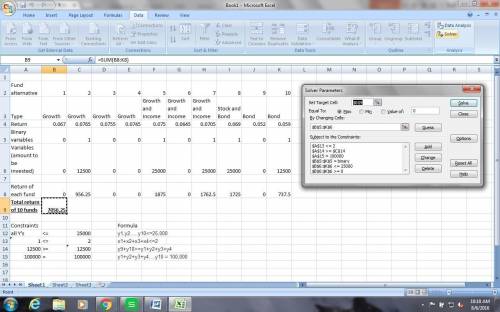

Dave has $100,000 to invest in 10 mutual fund alternatives with the following restrictions. For diversification, no more than $25,000 can be invested in any one fund. If a fund is chosen for investment, then at least $10,000 will be invested in it. No more than two of the funds can be pure growth funds, and at least one pure bond fund must be selected. The total amount invested in pure bond funds must be at least as much as the amount invested in pure growth funds. Using the following expected returns, formulate and solve a model that will determine the investment strategy that will maximize expected annual return.

Fund Type Expected Return (%)

1 Growth 6.70

2 Growth 7.65

3 Growth 7.55

4 Growth 7.45

5 Growth & Income 7.50

6 Growth & Income 6.45

7 Growth & Income 7.10

8 Stock & Bond 6.95

9 Bond 5.20

10 Bond 5.90

Answers: 2

Another question on Business

Business, 22.06.2019 03:10

On the first day of the fiscal year, a company issues an $7,500,000, 8%, five-year bond that pays semiannual interest of $300,000 ($7,500,000 × 8% × ½), receiving cash of $7,740,000. journalize the first interest payment and the amortization of the related bond premium. round to the nearest dollar. if an amount box does not require an entry, leave it blank.

Answers: 3

Business, 22.06.2019 11:30

Given the following information about the closed economy of brittania, what is the level of investment spending and private savings, and what is the budget balance? assume there are no government transfers. gdp=$1180.00 million =$510.00 million =$380.00 million =$280.00 million

Answers: 3

Business, 22.06.2019 18:00

1. what is the amount of interest earned after two years on a $100 deposit paying 4 percent simple interest annually? $8.00 $4.08 $8.16 $4.00 2. what is the amount of compound interest earned after three years on a $100 deposit paying 8 percent interest annually? $24.00 $8.00 $16.64 $25.97 3. a business just took out a loan for $100,000 at 10% interest. if the business pays the loan off in three months, how much did the business pay in interest? $2,500.00 $10.00 $250.00 $10,000.00 4. what is the annual percentage yield (apy) for a deposit paying 5 percent interest with monthly compounding? 5.00% 5.12% 79.59% 0.42%

Answers: 1

Business, 22.06.2019 20:10

Assume that a local bank sells two services, checking accounts and atm card services. the bank’s only two customers are mr. donethat and ms. beenthere. mr. donethat is willing to pay $8 a month for the bank to service his checking account and $2 a month for unlimited use of his atm card. ms. beenthere is willing to pay only $5 for a checking account, but is willing to pay $9 for unlimited use of her atm card. assume that the bank can provide each of these services at zero marginal cost.refer to scenario 17-5. if the bank is unable to use tying, what is the profit-maximizing price to charge for a checking account

Answers: 3

You know the right answer?

Dave has $100,000 to invest in 10 mutual fund alternatives with the following restrictions. For dive...

Questions

Mathematics, 19.02.2021 01:50

SAT, 19.02.2021 01:50

Health, 19.02.2021 01:50

Mathematics, 19.02.2021 01:50

Mathematics, 19.02.2021 01:50

SAT, 19.02.2021 01:50

Mathematics, 19.02.2021 01:50

Mathematics, 19.02.2021 01:50