Business, 25.04.2020 04:53 cynthiauzoma367

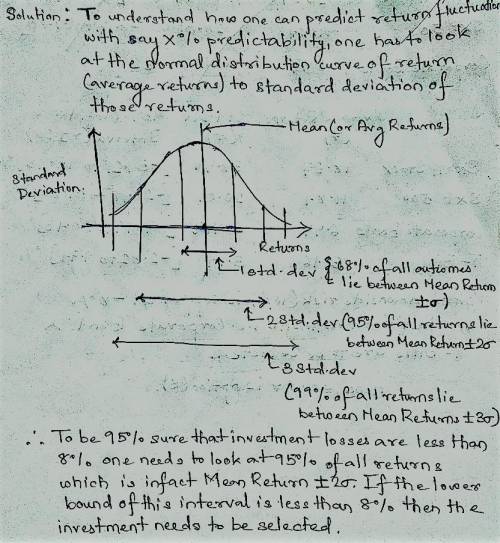

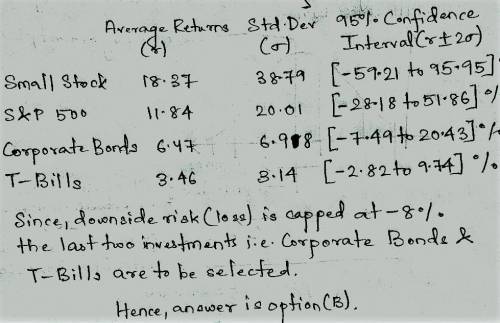

You are choosing between these four investments and you want to be 95% certain that you do not lose more than 8.00 % on your investment. Which investments could you choose?

Small Stocks S&P 500 Corporate Bonds T-Bills

Average return 18.37% 11.84% 6.47% 3.46%

Standard Deviation 38.79% 20.01% 6.98% 3.14%

of returns

(Select the best choice below.)

Which of the following have the lower bound of the estimated range greater than

18.00 %?

A. All of the Investments

B. T-Bills only

C. Long-term Government of Canada Bonds and T-Bills

D. S&P TSX and S&P 500 in CAD

E. Long-term Government of Canada Bonds and S&P 500 in CAD

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

What is the difference between a public and a private corporation?

Answers: 1

Business, 22.06.2019 19:40

Best burger is a major fast food chain. its managers are motivated to grow the firm in order to increase their market power and change the industry structure in their favor. which of the following strategies is most associated with their motive for growth? a. employing celebrity spokespeople b. implementing automated burger-making machinery c. purchasing competitors d. increasing executive salaries

Answers: 3

Business, 22.06.2019 23:30

Sole proprietorships produce more goods and services than does any other form of business organization.

Answers: 2

Business, 23.06.2019 04:10

Which of the following would not be listed under cash outflows in a financial plan?

Answers: 2

You know the right answer?

You are choosing between these four investments and you want to be 95% certain that you do not lose...

Questions

Mathematics, 16.11.2020 17:50

Computers and Technology, 16.11.2020 17:50

English, 16.11.2020 17:50

History, 16.11.2020 17:50

Geography, 16.11.2020 17:50

English, 16.11.2020 17:50

English, 16.11.2020 17:50