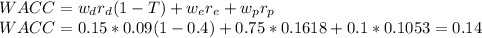

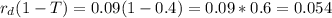

The company estimates that it can issue debt at a rate of rd = 9%, and its tax rate is 40%. It can issue preferred stock that pays a constant dividend of $6 per year at $57 per share. Also, its common stock currently sells for $39 per share; the next expected dividend, D1, is $4.75; and the dividend is expected to grow at a constant rate of 4% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. What is the cost of each of the capital components? Round your answers to two decimal places. Do not round your intermediate calculations. Cost of debt % Cost of preferred stock % Cost of retained earnings % What is Adamson's WACC? Round your answer to two decimal places. Do not round your intermediate calculations. % Only projects with expected returns that exceed WACC will be accepted. Which projects should Adamson accept? Project 1 Project 2 Project 3 Project 4

Answers: 3

Another question on Business

Business, 21.06.2019 22:30

Before contacting the news or print media about your business, what must you come up with first ? a. a media expertb. a big budgetc. a track recordd. a story angle

Answers: 1

Business, 22.06.2019 02:40

The following accounts are denominated in pesos as of december 31, 2015. for reporting purposes, these amounts need to be stated in u.s. dollars. for each balance, indicate the exchange rate that would be used if a translation is made under the current rate method. then, again for each account, provide the exchange rate that would be necessary if a remeasurement is being made using the temporal method. the company was started in 2000. the buildings were acquired in 2002 and the patents in 2003. (round your answers to 2 decimal places.) exchange rates for 1 peso are as follows: 2000 1 peso = $ 0.28 2002 1 = 0.26 2003 1 = 0.25 january 1, 2015 1 = 0.24 april 1, 2015 1 = 0.23 july 1, 2015 1 = 0.22 october 1, 2015 1 = 0.20 december 31, 2015 1 = 0.16 average for 2015 1 = 0.19

Answers: 3

Business, 22.06.2019 15:20

Garfield corporation is considering building a new plant in canada. it predicts sales at the new plant to be 50,000 units at $5.00/unit. below is a listing of estimated expenses. category total annual expenses % of annual expense that are fixed materials $50,000 10% labor $90,000 20% overhead $40,000 30% marketing/admin $20,000 50% a canadian firm was contracted to sell the product and will receive a commission of 10% of the sales price. no u.s. home office expenses will be allocated to the new facility. the contribution margin ratio for garfield corporation is

Answers: 2

Business, 22.06.2019 20:10

Assume that a local bank sells two services, checking accounts and atm card services. the bank’s only two customers are mr. donethat and ms. beenthere. mr. donethat is willing to pay $8 a month for the bank to service his checking account and $2 a month for unlimited use of his atm card. ms. beenthere is willing to pay only $5 for a checking account, but is willing to pay $9 for unlimited use of her atm card. assume that the bank can provide each of these services at zero marginal cost.refer to scenario 17-5. if the bank is unable to use tying, what is the profit-maximizing price to charge for a checking account

Answers: 3

You know the right answer?

The company estimates that it can issue debt at a rate of rd = 9%, and its tax rate is 40%. It can i...

Questions

Mathematics, 13.04.2021 01:00

Mathematics, 13.04.2021 01:00

Mathematics, 13.04.2021 01:00

English, 13.04.2021 01:00

Mathematics, 13.04.2021 01:00

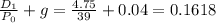

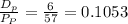

) = 10.53%

) = 10.53% ) = 16.18%

) = 16.18% ) = 9% = 0.09

) = 9% = 0.09

) = $6

) = $6

) = $57

) = $57

)= $39

)= $39

) = $4.75

) = $4.75

), 15% debt (

), 15% debt ( ), and 10% preferred stock (

), and 10% preferred stock ( )

)

= 10.53%

= 10.53%