Business, 25.04.2020 00:34 yassinesayedahmad1

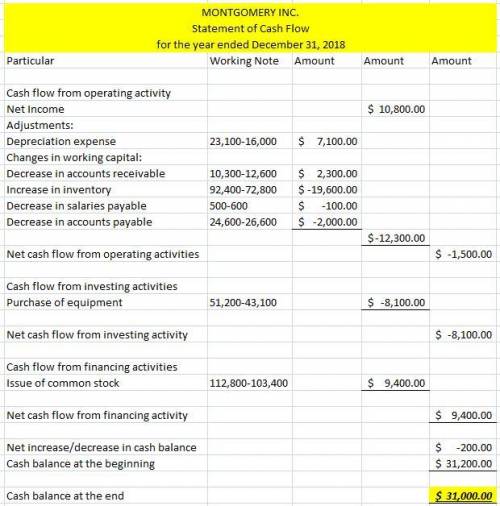

Preparing statement of cash flows LO P1, P2, P3

MONTGOMERY INC.

Comparative Balance Sheets

December 31, 2018 and 2017

2018 2017

Assets

Cash $ 31,000 $ 31,200

Accounts receivable, net 10,300 12,600

Inventory 92,400 72,800

Total current assets 133,700 116,600

Equipment 51,200 43,100

Accum. depreciation—Equipment (23,100) (16,000)

Total assets $ 161,800 $ 143,700

Liabilities and Equity

Accounts payable $ 24,600 $ 26,600

Salaries payable 500 600

Total current liabilities 25,100 27,200

Equity

Common stock, no par value 112,800 103,400

Retained earnings 23,900 13,100

Total liabilities and equity $ 161,800 $ 143,700

MONTGOMERY INC.

Income Statement

For Year Ended December 31, 2018

Sales $ 45,900

Cost of goods sold (19,100)

Gross profit 26,800

Operating expenses

Depreciation expense $ 7,100

Other expenses 5,500

Total operating expense 12,600

Income before taxes 14,200

Income tax expense 3,400

Net income $ 10,800

Additional Information

No dividends are declared or paid in 2018.

Issued additional stock for $9,400 cash in 2018.

Purchased equipment for cash in 2018; no equipment was sold in 2018.

Use the above financial statements and additional information to prepare a statement of cash flows for the year ended December 31, 2018, using the indirect method.

Answers: 2

Another question on Business

Business, 22.06.2019 00:00

Pettijohn inc. the balance sheet and income statement shown below are for pettijohn inc. note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. balance sheet (millions of $) assets 2016 cash and securities $ 1,554.0 accounts receivable 9,660.0 inventories 13,440.0 total current assets $24,654.0 net plant and equipment 17,346.0 total assets $42,000.0 liabilities and equity accounts payable $ 7,980.0 notes payable 5,880.0 accruals 4,620.0 total current liabilities $18,480.0 long-term bonds 10,920.0 total debt $29,400.0 common stock 3,360.0 retained earnings 9,240.0 total common equity $12,600.0 total liabilities and equity $42,000.0 income statement (millions of $) 2016 net sales $58,800.0 operating costs except depr'n $54,978.0 depreciation $ 1,029.0 earnings bef int and taxes (ebit) $ 2,793.0 less interest 1,050.0 earnings before taxes (ebt) $ 1,743.0 taxes $ 610.1 net income $ 1,133.0 other data: shares outstanding (millions) 175.00 common dividends $ 509.83 int rate on notes payable 1. what is the firm's current ratio? (points : 6) 0.97 1.08 1.20 1.33 2. what is the firm's quick ratio? (points : 6) 0.49 0.61 0.73 0.87 3. what is the firm's total assets turnover? (points : 6) 0.90 1.12 1.40 1.68 4. what is the firm's inventory turnover ratio? (points : 6) 4.38 4.59 4.82 5.06 5. what is the firm's debt ratio? (points : 6) 45.93% 51.03% 56.70% 70.00% 6. what is the firm's roa? (points : 6) 2.70% 2.97% 3.26% 3.59% 7. what is the firm's roe? (points : 6) 8.54% 8.99% 9.44% 9.91%

Answers: 2

Business, 22.06.2019 03:00

What is the relationship between marginal external cost, marginal social cost, and marginal private cost? a. marginal social cost equals marginal private cost plus marginal external cost. b. marginal private cost plus marginal social cost equals marginal external cost. c. marginal social cost plus marginal external cost equals marginal private cost. d. marginal external cost equals marginal private cost minus marginal social cost. marginal external cost a. is expressed in dollars, so it is not an opportunity cost b. is an opportunity cost borne by someone other than the producer c. is equal to two times the marginal private cost d. is a convenient economics concept that is not real

Answers: 3

Business, 22.06.2019 11:00

Factors like the unemployment rate,the stock market,global trade,economic policy,and the economic situation of other countries have no influence on the financial status of individuals. true or false

Answers: 1

Business, 22.06.2019 11:30

Margaret company reported the following information for the current year: net sales $3,000,000 purchases $1,957,000 beginning inventory $245,000 ending inventory $115,000 cost of goods sold 65% of sales industry averages available are: inventory turnover 5.29 gross profit percentage 28% how do the inventory turnover and gross profit percentage for margaret company compare to the industry averages for the same ratios? (round inventory turnover to two decimal places. round gross profit percentage to the nearest percent.)

Answers: 2

You know the right answer?

Preparing statement of cash flows LO P1, P2, P3

MONTGOMERY INC.

Comparative Balanc...

MONTGOMERY INC.

Comparative Balanc...

Questions

Biology, 10.05.2021 20:40

Mathematics, 10.05.2021 20:40

English, 10.05.2021 20:40

History, 10.05.2021 20:40

Biology, 10.05.2021 20:40

Biology, 10.05.2021 20:40

Mathematics, 10.05.2021 20:40