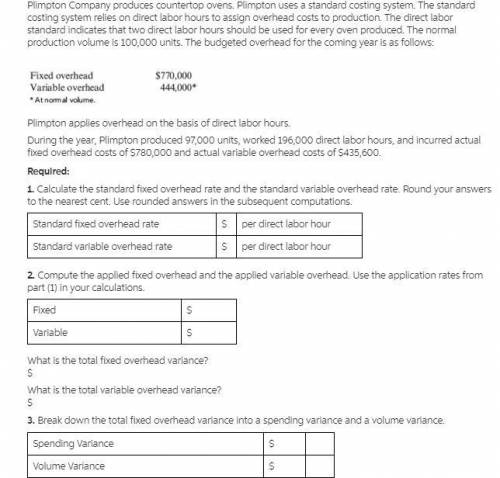

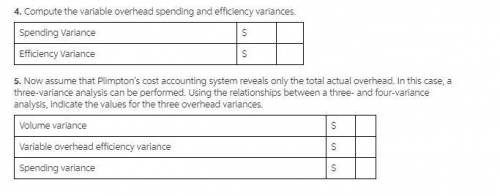

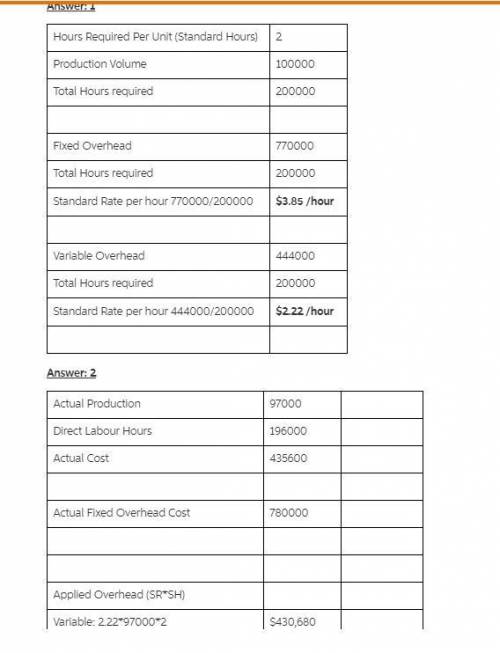

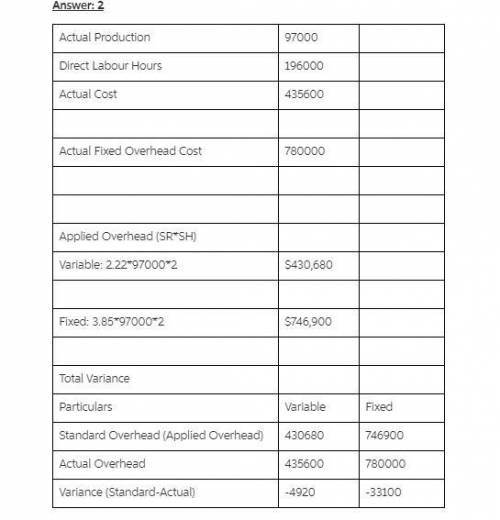

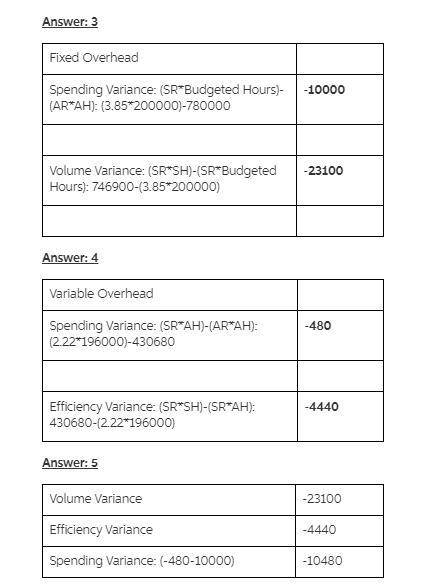

Overhead Application, Overhead Variances, Journal EntriesPlimpton Company produces countertop ovens. Plimpton uses a standard costing system. The standard costing system relies on direct labor hours to assign overhead costs to production. The direct labor standard indicates that two direct labor hours should be used for every oven produced. The normal production volume is 100,000 units. The budgeted overhead for the coming year is as follows:Fixed overhead $760,000Variable overhead 446,000**At normal volume. Plimpton applies overhead on the basis of direct labor hours. During the year, Plimpton produced 97,000 units, worked 196,000 direct labor hours, and incurred actual fixed overhead costs of $770,400 and actual variable overhead costs of $437,580.Required:1. Calculate the standard fixed overhead rate and the standard variable overhead rate. Round your answers to the nearest cent. Use rounded answers in the subsequent computations. Standard fixed overhead rate $ per direct labor hourStandard variable overhead rate $ per direct labor hour2. Compute the applied fixed overhead and the applied variable overhead. Use the application rates from part (1) in your calculations. Fixed $Variable $What is the total fixed overhead variance?$ UnfavorableWhat is the total variable overhead variance?$ Unfavorable3. Break down the total fixed overhead variance into a spending variance and a volume variance. Spending Variance $ UnfavorableVolume Variance $ Unfavorable4. Compute the variable overhead spending and efficiency variances. Spending Variance $ UnfavorableEfficiency Variance $ Unfavorable5. Now assume that Plimpton’s cost accounting system reveals only the total actual overhead. In this case, a three-variance analysis can be performed. Using the relationships between a three- and four-variance analysis, indicate the values for the three overhead variances. Volume variance $ UnfavorableVariable overhead efficiency variance $ UnfavorableSpending variance $ UnfavorableFeedback6. Prepare journal entries (1) to apply overhead to production, (2) to record the actual overhead costs incurred, (3) to record the variable and fixed overhead variances, and (4) to close the variance accounts at the end of the year. Assume variances are closed to Cost of Goods Sold. If an amount box does not require an entry, leave it blank or enter "0".

Answers: 2

Another question on Business

Business, 21.06.2019 22:50

Tara incorporates her sole proprietorship, transferring it to newly formed black corporation. the assets transferred have an adjusted basis of $240,000 and a fair market value of $300,000. also transferred was $10,000 in liabilities, $1,000 of which was personal and the balance of $9,000 being business related. in return for these transfers, tara receives all of the stock in black corporation. a. black corporation has a basis of $241,000 in the property. b. black corporation has a basis of $240,000 in the property. c. tara’s basis in the black corporation stock is $241,000. d. tara’s basis in the black corporation stock is $249,000. e. none of the above.

Answers: 1

Business, 21.06.2019 23:10

At the end of the current year, $59,500 of fees have been earned but have not been billed to clients. required: a. journalize the adjusting entry to record the accrued fees on december 31. refer to the chart of accounts for exact wording of account titles. b. if the cash basis rather than the accrual basis had been used, would an adjusting entry have been necessary?

Answers: 2

Business, 22.06.2019 02:30

Consider how health insurance affects the quantity of health care services performed. suppose that the typical medical procedure has a cost of $160, yet a person with health insurance pays only $40 out of pocket. her insurance company pays the remaining $120. (the insurance company recoups the $120 through premiums, but the premium a person pays does not depend on how many procedures that person chooses to undergo.) consider the following demand curve in the market for medical care. use the black point (plus symbol) to indicate the quantity of procedures demanded if each procedure has a price of $160. then use the grey point (star symbol) to indicate the quantity of procedures demanded if each procedure has a price of $40. q d at p=$160 q d at p=$40 0 10 20 30 40 50 60 70 80 90 100 200 180 160 140 120 100 80 60 40 20 0 price of medical procedures quantity of medical procedures demand if the cost of each procedure to society is truly $160, the quantity that maximizes total surplus is procedures. economists often blame the health insurance system for excessive use of medical care. given your analysis, the use of care might be viewed as excessive because consumers get procedures whose value is than the cost of producing them.

Answers: 1

Business, 22.06.2019 10:00

You are president of a large corporation. at a typical monthly meeting, each of your vice presidents gives standard area reports. in the past, these reports have been good, and the vps seem satisfied about their work. based on situational approach to leadership, which leadership style should you exhibit at the next meeting?

Answers: 2

You know the right answer?

Overhead Application, Overhead Variances, Journal EntriesPlimpton Company produces countertop ovens....

Questions

English, 09.03.2022 15:50

Mathematics, 09.03.2022 15:50

Mathematics, 09.03.2022 15:50

Mathematics, 09.03.2022 15:50

Mathematics, 09.03.2022 15:50

English, 09.03.2022 15:50

Mathematics, 09.03.2022 15:50

World Languages, 09.03.2022 15:50

Mathematics, 09.03.2022 15:50

Mathematics, 09.03.2022 15:50

Mathematics, 09.03.2022 15:50

Geography, 09.03.2022 15:50

History, 09.03.2022 15:50

Physics, 09.03.2022 15:50

Chemistry, 09.03.2022 15:50