Business, 23.04.2020 01:05 rachelacarman

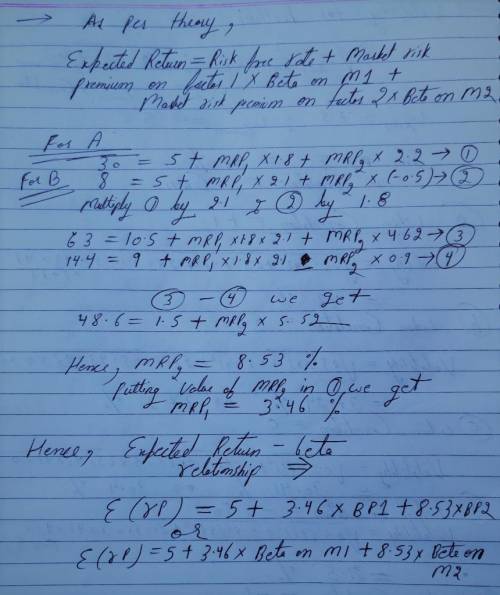

Suppose there are two independent economic factors, M1 and M2. The risk-free rate is 5%, and all stocks have independent firm-specific components with a standard deviation of 40%. Portfolios A and B are both well diversified. Portfolio Beta on M1 Beta on M2 Expected Return (%) A 1.8 2.2 30 B 2.1 -0.5 8 What is the expected return–beta relationship in this economy?

Answers: 1

Another question on Business

Business, 22.06.2019 13:40

A.j. was a newly hired attorney for idle time gaming, inc. even though he reported directly to the president of the company, a.j. noticed that the president always had time to converse with the director of sales, calling on him to get a pulse on legal/regulatory issues that, as the company attorney, a.j. could have probably handled. a.j. also noted that the hr manager’s administrative assistant was the go-to person for a number of things that would make life easier at work. a.j. was recognizing the culture at idle time gaming.

Answers: 3

Business, 23.06.2019 01:30

How is systematic decision making related to being financially responsible

Answers: 1

You know the right answer?

Suppose there are two independent economic factors, M1 and M2. The risk-free rate is 5%, and all sto...

Questions

Mathematics, 15.10.2020 20:01

History, 15.10.2020 20:01

Mathematics, 15.10.2020 20:01

History, 15.10.2020 20:01

Computers and Technology, 15.10.2020 20:01

Mathematics, 15.10.2020 20:01

History, 15.10.2020 20:01

Chemistry, 15.10.2020 20:01

Mathematics, 15.10.2020 20:01

History, 15.10.2020 20:01

Mathematics, 15.10.2020 20:01

Mathematics, 15.10.2020 20:01