Business, 22.04.2020 04:09 SumayahAminaAnsari

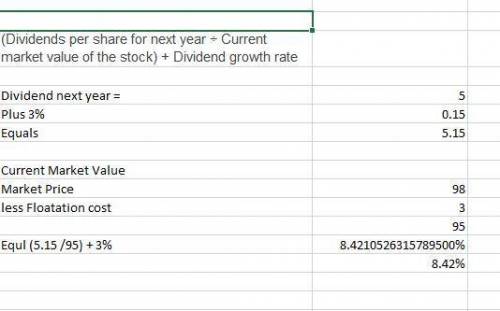

Firm X just paid $5/share dividend. We expect the dividend to grow annually at a constant rate 3%. The current stock price is $100. If firm X issues new equity, the new shares would sell at $98/share and the firm also needs to pay investment banks $3/share flotation cost. What is the cost of retained earnings? g

Answers: 2

Another question on Business

Business, 22.06.2019 03:00

In the supply-and-demand schedule shown above, at the lowest price of $50, producers supply music players and consumers demand music players.

Answers: 2

Business, 22.06.2019 16:10

The brs corporation makes collections on sales according to the following schedule: 30% in month of sale 66% in month following sale 4% in second month following sale the following sales have been budgeted: sales april $ 130,000 may $ 150,000 june $ 140,000 budgeted cash collections in june would be:

Answers: 1

Business, 22.06.2019 17:30

What is one counter argument to the premise that the wealth gap is a serious problem which needs to be addressed?

Answers: 1

Business, 23.06.2019 09:50

Leading guitar string producer wound up inc. has enjoyed a competitive advantage based on its proprietary coating that gives its strings a clearer sound and longer lifespan than uncoated strings. one of wound up's competitors, however, has recently developed a similar coating using less expensive ingredients, which allows it to charge a lower price than wound up for similar-quality strings. wound up's competitive advantage is in danger due to a. a lack of perceived value b. a lack of organization c. direct imitation and substitution d. resource immobility

Answers: 3

You know the right answer?

Firm X just paid $5/share dividend. We expect the dividend to grow annually at a constant rate 3%. T...

Questions

Mathematics, 16.10.2020 17:01

History, 16.10.2020 17:01

History, 16.10.2020 17:01

English, 16.10.2020 17:01

Chemistry, 16.10.2020 17:01

History, 16.10.2020 17:01

Mathematics, 16.10.2020 17:01

Mathematics, 16.10.2020 17:01

Advanced Placement (AP), 16.10.2020 17:01