Business, 22.04.2020 02:18 Miamonroe2004

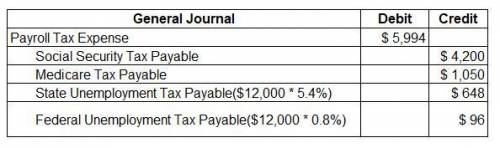

The payroll register of Heritage Co. indicates $4,200 of social security withheld and $1,050 of Medicare tax withheld on total salaries of $70,000 for the period. Earnings of $12,000 are subject to state and federal unemployment compensation taxes at the federal rate of 0.8% and the state rate of 5.4%.

Provide the journal entry to record the payroll tax expense for the period. If an amount box does not require an entry, leave it blank.

a. Payroll Tax Expense

b. Social Security Tax Payable

c. Medicare Tax Payable

d. State Unemployment Tax Payable e. Federal Unemployment Tax Payable

Answers: 2

Another question on Business

Business, 22.06.2019 08:00

Why do police officers get paid less than professional baseball players?

Answers: 2

Business, 22.06.2019 09:30

An object that is clicked on and takes the presentation to a new targeted file is done through a

Answers: 2

Business, 22.06.2019 11:30

Which of the following is not an example of one of the four mail advantages of prices on a free market economy

Answers: 1

Business, 22.06.2019 20:00

Harry is 25 years old with a 1.55 rating factor for his auto insurance. if his annual base premium is $1,012, what is his total premium? $1,568.60 $2,530 $1,582.55 $1,842.25

Answers: 1

You know the right answer?

The payroll register of Heritage Co. indicates $4,200 of social security withheld and $1,050 of Medi...

Questions

Chemistry, 18.10.2019 05:00

History, 18.10.2019 05:00

Physics, 18.10.2019 05:00

Social Studies, 18.10.2019 05:00

Computers and Technology, 18.10.2019 05:00

Computers and Technology, 18.10.2019 05:00