Business, 22.04.2020 02:24 kodakcam02

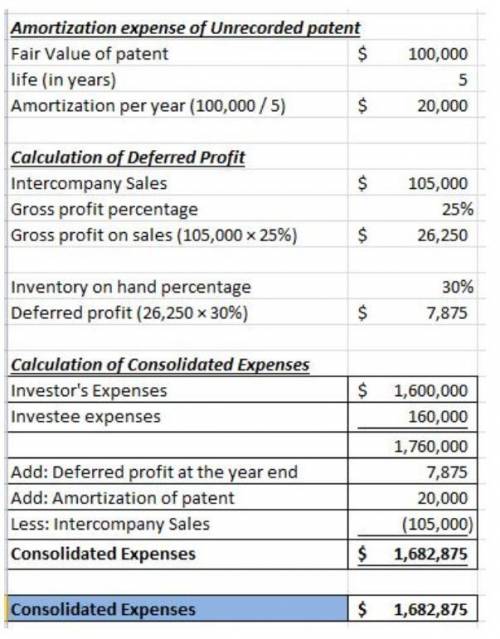

Assume that a parent company acquired 80% of the outstanding voting common stock of a subsidiary on January 1, 2012. On the acquisition date, the identifiable net assets of the subsidiary had fair values that approximated their recorded book values except for a patent, which had a fair value of $100,000 and no recorded book value. On the date of acquisition, the patent had 5 years of remaining useful life and the parent company amortizes its intangible assets using straight line amortization. During the year ended December 31, 2013, the subsidiary recorded sales to the parent in the amount of $105,000. On these sales, the subsidiary recorded pre-consolidation gross profits equal to 25%. Approximately 30% of this merchandise remains in the parent's inventory at December 31, 2013. The following summarized pre-consolidation financial statements are for the parent and the subsidiary for the year ended December 31, 2013: Investor Investee Income statement: Revenues $2,400,000 $321,000 Equity income 106,500 0 Expenses (1,600,000) (160,000) Net income $906,500 $161,000 Retained earnings statement: BOY retained earnings $752,000 $40,000 Net income 906,500 161,000 Dividends declared (64,000) (40,000) EOY retained earnings $1,594,500 $161,000 Balance sheet: Current assets $800,000 $101,000 Equity investment 234,500 - Noncurrent assets 4,000,000 300,000 Total assets $5,034,500 $401,000 Liabilities $2,640,000 $160,000 Common stock & APIC 800,000 80,000 Retained earnings 1,594,500 161,000 Total liabilities & stockholders' equity $5,034,500 $401,000 Based on this information, determine the balance for Noncontrolling Interest: $32,200 $58,625 $24,100 $18,625

Answers: 2

Another question on Business

Business, 22.06.2019 05:00

Ajewelry direct sales company pays its consultants based on recruiting new members. question 1 options: the company is running a pyramid scheme, which is illegal. the company is running a pyramid scheme, which is legal. the company has implemented a legal and ethical plan for growth. the company uses this method of compensation to reduce the fee for the product sample kit.

Answers: 3

Business, 22.06.2019 20:00

Suppose a country's productivity last year was 84. if this country's productivity growth rate of 5 percent is to be maintained, this means that this year's productivity will have to be:

Answers: 2

Business, 23.06.2019 00:10

Many years ago, sprint telecommunications aired an advertisement intended to demonstrate the clarity of reception sprint customers could expect. the ad showed a rancher, who had used a different company, complaining that he had ordered 100 oxen from his supplier and instead received 100 dachshunds. the mix-up was probably due to the presence of in the communication process.

Answers: 3

Business, 23.06.2019 00:10

Wang distributors has an annual demand for an airport metal detector of 1 comma 350 units. the cost of a typical detector to wang is $400. carrying cost is estimated to be 19% of the unit cost, and the ordering cost is $24 per order. if ping wang, the owner, orders in quantities of 300 or more, he can get a 10% discount on the cost of the detectors. should wang take the quantity discount? \

Answers: 1

You know the right answer?

Assume that a parent company acquired 80% of the outstanding voting common stock of a subsidiary on...

Questions

Mathematics, 16.01.2021 01:00

Health, 16.01.2021 01:00

Business, 16.01.2021 01:00

History, 16.01.2021 01:00

Mathematics, 16.01.2021 01:00

Mathematics, 16.01.2021 01:00

Biology, 16.01.2021 01:00

Biology, 16.01.2021 01:00

Mathematics, 16.01.2021 01:00

Mathematics, 16.01.2021 01:00