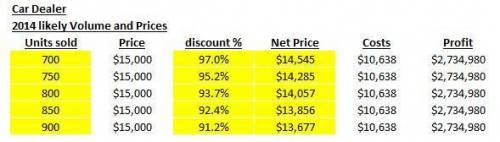

In November 2013, a car dealer is trying to determine how many cars to order from the manufacturer for 2014. A car ordered in 2013 cost $10000. The dealer expects that each car ordered from the manufacturer will cost 4% to 8% more in 2014. The selling price for each car in 2013 was $15000 but the dealer expects he will have to give a discount because of heavy competition, and that the selling price in 2014 will be between 93% and 98% of the 2013 price. The dealer expects to sell between 700 and 900 cars. Refer to the Car Dealership Problem and start with the original values. The cost increase is 6.38%. If the dealer's profits are $2,734,980, what was the discount and how many cars did the dealer sell?

Answers: 3

Another question on Business

Business, 21.06.2019 22:50

Which of the following statements is true? a job costing system will have a separate work in process account for each of the major processes. a process costing system will have a single work in process account. a process costing system will have a separate raw materials account for each of the major processes. a process costing system will have a separate work in process account for each of the major processes.

Answers: 3

Business, 22.06.2019 02:00

Benton company (bc), a calendar year entity, has one owner, who is in the 37% federal income tax bracket (any net capital gains or dividends would be taxed at a 20% rate). bc's gross income is $395,000, and its ordinary trade or business deductions are $245,000. ignore the standard deduction (or itemized deductions) and the deduction for qualified business income. if required, round computations to the nearest dollar. a. bc is operated as a proprietorship, and the owner withdraws $100,000 for personal use. bc's taxable income for the current year is $ , and the tax liability associated with the income from the sole proprietorship is $ . b. bc is operated as a c corporation, pays out $100,000 as salary, and pays no dividends to its shareholder. bc's taxable income for the current year is $ , and bc's tax liability is $ . the shareholder's tax liability is $ . c. bc is operated as a c corporation and pays out no salary or dividends to its shareholder. bc's taxable income for the current year is $ , and bc's tax liability is $ . d. bc is operated as a c corporation, pays out $100,000 as salary, and pays out the remainder of its earnings as dividends. bc's taxable income for the current year is $ , and bc's tax liability is $ .

Answers: 2

Business, 22.06.2019 11:40

Select the correct answer. which is a benefit of planning for your future career? a.being less prepared after high school. b.having higher tuition in college. c.earning college credits in high school. d.ruining your chances of having a successful career.

Answers: 2

Business, 22.06.2019 15:00

Which of the following is least likely to a team solve problems together

Answers: 1

You know the right answer?

In November 2013, a car dealer is trying to determine how many cars to order from the manufacturer f...

Questions

Geography, 03.12.2021 02:50

Mathematics, 03.12.2021 02:50

Chemistry, 03.12.2021 02:50

Computers and Technology, 03.12.2021 02:50

Business, 03.12.2021 02:50

Mathematics, 03.12.2021 02:50

Spanish, 03.12.2021 02:50

Health, 03.12.2021 02:50

Biology, 03.12.2021 02:50

Chemistry, 03.12.2021 02:50