Business, 22.04.2020 01:03 nacgrading3p6d8pf

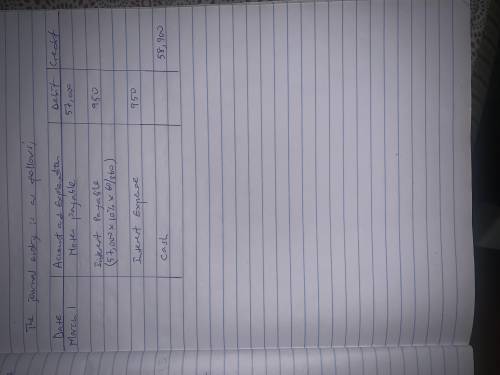

On November 1, Alan Company signed a 120-day, 10% note payable, with a face value of $57,000. Alan made the appropriate year-end accrual. What is the journal entry as of March 1 to record the payment of the note assuming no reversing entry was made

Answers: 3

Another question on Business

Business, 22.06.2019 17:30

Alinguist had a gross income of 53,350 last year. if 17.9% of his income got witheld for federal income tax, how much of the linguist's pay got witheld for federal income tax last year?

Answers: 2

Business, 22.06.2019 19:10

Ancho corp. is an automobile company whose core competency lies in manufacturing petrol- and diesel- based cars. the company realizes that more of its potential customers are switching to electric cars. the r& d department of the company acquires competencies in developing electric cars and launches its first hybrid car, which uses both gas and electricity. in this scenario, ancho is primarilya. leveraging new core competencies to improve current market position. b. redeploying existing core competencies to compete in future markets. c. unlearning existing core competencies to create and compete in markets of the future. d. building new core competencies to protect and extend current market position

Answers: 3

Business, 22.06.2019 21:30

True or false payroll withholding includes income tax, social security tax, medicare tax as well as money you deduct for your retirement fund.

Answers: 1

Business, 22.06.2019 22:00

On january 8, the end of the first weekly pay period of the year, regis company's payroll register showed that its employees earned $22,760 of office salaries and $70,840 of sales salaries. withholdings from the employees' salaries include fica social security taxes at the rate of 6.20%, fica medicare taxes at the rate of 1.45%, $13,260 of federal income taxes, $1,450 of medical insurance deductions, and $860 of union dues. no employee earned more than $7,000 in this first pay period. required: 1.1 calculate below the amounts for each of these four taxes of regis company. regis’s merit rating reduces its state unemployment tax rate to 3% of the first $7,000 paid to each employee. the federal unemployment tax rate is 0.60

Answers: 3

You know the right answer?

On November 1, Alan Company signed a 120-day, 10% note payable, with a face value of $57,000. Alan m...

Questions

Mathematics, 09.02.2021 17:30

Mathematics, 09.02.2021 17:30

Advanced Placement (AP), 09.02.2021 17:30

Mathematics, 09.02.2021 17:30

Computers and Technology, 09.02.2021 17:30

Mathematics, 09.02.2021 17:30

Spanish, 09.02.2021 17:30

Spanish, 09.02.2021 17:30

Mathematics, 09.02.2021 17:30