Business, 21.04.2020 19:11 Aliyah2020

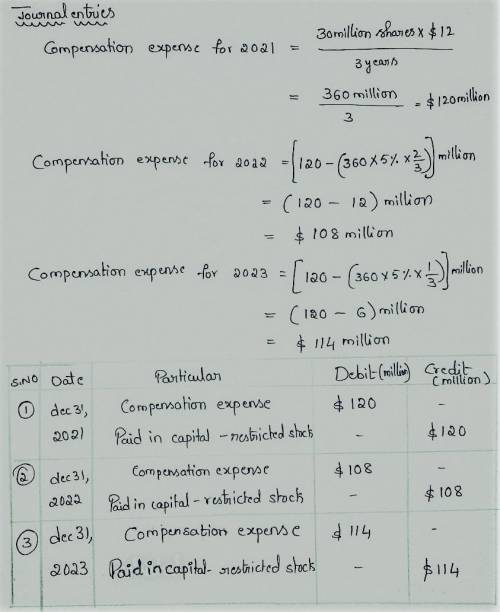

On January 1, 2021, David Mest Communications granted restricted stock units (RSUS) representing 30 million of its $1 par common shares to executives, subject to forfeiture if employment is terminated within three years. After the recipients of the RSUS satisfy the vesting requirement, the company will distribute the shares. The common shares had a market price of $18 per share on the grant date. At the date of grant, Mest anticipated that 6% of the recipients would leave the firm prior to vesting. On January 1, 2022, 5% of the RSUs are forfeited due to executive turnover. Mest chooses the option to account for forfeitures when they actually occur. Required: 1. to 3. Prepare the appropriate journal entries to record compensation expense on December 31, 2021, December 31, 2022, and December 31, 2023.

Answers: 3

Another question on Business

Business, 22.06.2019 00:20

Suppose that the world price of steel is $100 a ton, india does not trade internationally, and the equilibrium price of steel in india is $60 a ton. suppose that india now begins to trade internationally. the price of steel in india the quantity of steel produced in india a. does not change; does not change b. falls; increases c. falls; decreases d. rises; decreases e. rises; increases the quantity of steel bought by india india steel. a. increases; exports b. decreases; imports c. decreases; exports d. does not change; neither imports nor exports e. increases; imports

Answers: 2

Business, 22.06.2019 07:30

Miko willingly admits that she is not an accountant by training. she is concerned that her balance sheet might not be correct. she has provided you with the following additional information. 1. the boat actually belongs to miko, not to skysong, inc.. however, because she thinks she might take customers out on the boat occasionally, she decided to list it as an asset of the company. to be consistent, she also listed as a liability of the corporation her personal loan that she took out at the bank to buy the boat. 2. the inventory was originally purchased for $27,500, but due to a surge in demand miko now thinks she could sell it for $39,600. she thought it would be best to record it at $39,600. 3. included in the accounts receivable balance is $11,000 that miko loaned to her brother 5 years ago. miko included this in the receivables of skysong, inc. so she wouldn’t forget that her brother owes her money. (b) provide a corrected balance sheet for skysong, inc.. (hint: to get the balance sheet to balance, adjust stockholders’ equity.) (list assets in order of liquidity.)

Answers: 1

Business, 22.06.2019 11:10

Wilson company paid $5,000 for a 4-month insurance premium in advance on november 1, with coverage beginning on that date. the balance in the prepaid insurance account before adjustment at the end of the year is $5,000, and no adjustments had been made previously. the adjusting entry required on december 31 is: (a) debit cash. $5,000: credit prepaid insurance. $5,000. (b) debit prepaid insurance. $2,500: credit insurance expense. $2500. (c) debit prepaid insurance. $1250: credit insurance expense. $1250. (d) debit insurance expense. $1250: credit prepaid insurance. $1250. (e) debit insurance expense. $2500: credit prepaid insurance. $2500.

Answers: 1

Business, 22.06.2019 14:00

Which of the following would be an accurate statement about achieving a balanced budget

Answers: 1

You know the right answer?

On January 1, 2021, David Mest Communications granted restricted stock units (RSUS) representing 30...

Questions

Mathematics, 15.09.2021 06:40

English, 15.09.2021 06:40

Mathematics, 15.09.2021 06:40

English, 15.09.2021 06:40

English, 15.09.2021 06:40

Mathematics, 15.09.2021 06:40

Social Studies, 15.09.2021 06:40

Computers and Technology, 15.09.2021 06:40

Physics, 15.09.2021 06:50

Mathematics, 15.09.2021 06:50

Social Studies, 15.09.2021 06:50

Arts, 15.09.2021 06:50