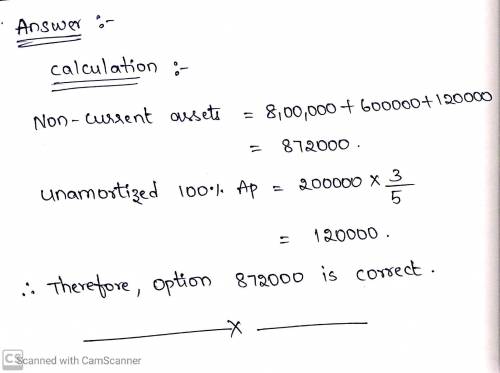

Assume a parent company acquired 80% of the outstanding voting common stock of a subsidiary on January 1, 2018. On the acquisition date, the identifiable net assets of the subsidiary had fair values that approxi-mated their recorded book values except for a patent, which had a fair value of $200,000 and no recorded book value. On the date of acquisition, the patent had five years of remaining useful life and the parent com-pany amortizes its intangible assets using straight line amortization. During the year ended December 31, 2019, the subsidiary recorded sales to the parent in the amount of $240,000. On these sales, the subsidiary recorded pre-consolidation gross profits equal to 25%. Approximately 30% of this merchandise remains in the parent’s inventory at December 31, 2019. The following summarized pre-consolidation financial state-ments are for the parent and the subsidiary for the year ended December 31, 2019:

Answers: 2

Another question on Business

Business, 22.06.2019 09:20

Which statement best defines tuition? tuition is federal money awarded to a student. tuition is aid given to a student by an institution. tuition is money borrowed to pay for an education. tuition is the price of attending classes at a school.

Answers: 1

Business, 22.06.2019 16:20

Carlos hears juan and rita’s complaints about the new employees with whom they have to work with, as well as their threats to quit the company. if carlos were to reassign juan and rita to new, unique roles and separate them from the ronny and bill, it would signal that carlos has moved into the stage of managing resistance.

Answers: 3

Business, 22.06.2019 17:00

Serious question, which is preferred in a business? pp or poopoo?

Answers: 1

Business, 22.06.2019 21:30

Consider the following three bond quotes; a treasury note quoted at 87.25, and a corporate bond quoted at 102.42, and a municipal bond quoted at 101.45. if the treasury and corporate bonds have a par value of $1,000 and the municipal bond has a par value of $5,000, what is the price of these three bonds in dollars? multiple choice $872.50, $1,000, $1,000, respectively $1,000, $1,024.20, $1,001.45, respectively $872.50, $1,024.20, $5,072.50, respectively $1,000, $1,000, $1,000, respectively

Answers: 3

You know the right answer?

Assume a parent company acquired 80% of the outstanding voting common stock of a subsidiary on Janua...

Questions

Business, 20.10.2021 02:00

Mathematics, 20.10.2021 02:00

Mathematics, 20.10.2021 02:00

Biology, 20.10.2021 02:00

Arts, 20.10.2021 02:00

Mathematics, 20.10.2021 02:00

English, 20.10.2021 02:00

Mathematics, 20.10.2021 02:00

English, 20.10.2021 02:00

Mathematics, 20.10.2021 02:00