Business, 21.04.2020 03:07 michaelgold1

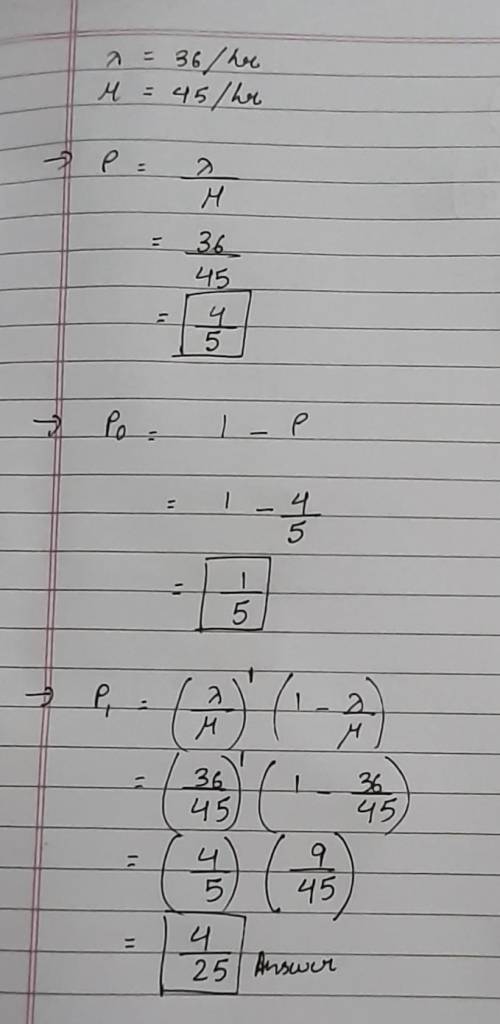

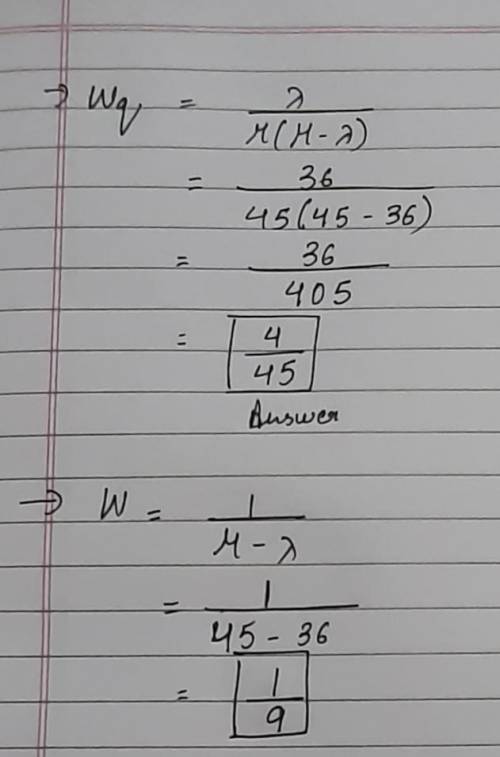

Use the following scenario and data for all questions During lunch time, customers arrive at a postal office at a rate of per hour. The interarrival time of the arrival process can be approximated with an exponential distribution. Customers can be served by the postal office at a rate of per hour. The service time for the customers can also be approximated with an exponential distribution. For each of the following questions, show your work and use the right notation. Determine the utilization factor.

A) rho =4/5

B) rho =5/4

C) rho =2/3

D) rho=45-36=9

E) None of the above.

Determine the probability that the system is idle, i. e., no customer is waiting or being served.

A) rho_0= 4/5

B) rho_0= 5/4

C) rho_0=1/5

D) rho_0= 1/9

E) None of the above

Determine the probability that exactly one customer is in the system, i. e., no customer is waiting but one is served.

A) rho_1=1/9

B) rho_1=2/5

C) rho_1=1/5

D) rho_1=4/25

E) None of the above

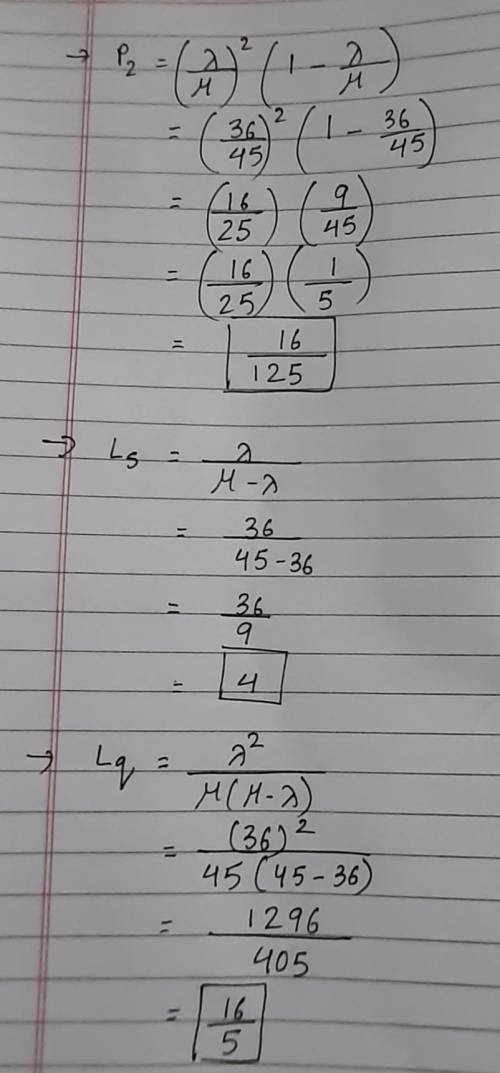

Determine the probability that exactly one customer is waiting

A) p_2=2/81

B) p_2=16/125

C) p_2=4/125

D) p_2=4/25

E) None of the above

Determine the expected number of customers in the system including the one being served and the ones waiting in the queue

A) L=4

B) L=16/5

C) L=12/5

D) L=18/5

E) None of the above

Determine the expected length of the queue, i. e., the number of customer waiting in the queue.

A) L_q=4

B) L_q=16/5

C) L_q=12/5

D) L_q=18/5

E) None of the above

Answers: 2

Another question on Business

Business, 21.06.2019 18:00

Sara bought 12 3/4 cakes sara's friends ate 3/8 how much cake is left

Answers: 1

Business, 22.06.2019 15:20

Martinez company has the following two temporary differences between its income tax expense and income taxes payable. 2017 2018 2019 pretax financial income $873,000 $866,000 $947,000 (2017' 2018, 2019) excess depreciation expense on tax return (29,400 ) (39,000 ) (9,600 ) (2017' 2018, 2019) excess warranty expense in financial income 20,000 9,900 8,300 (2017' 2018, 2019) taxable income $863,600 $836,900 $945,700(2017' 2018, 2019) the income tax rate for all years is 40%. instructions: a. prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019. b. assuming there were no temporary differences prior to 2016, indicate how deferred taxes will be reported on the 2016 balance sheet. button's warranty is for 12 months. c. prepare the income tax expense section of the income statement for 2017, beginning with the line, "pretax financial income."

Answers: 3

Business, 22.06.2019 18:00

Biochemical corp. requires $600,000 in financing over the next three years. the firm can borrow the funds for three years at 10.80 percent interest per year. the ceo decides to do a forecast and predicts that if she utilizes short-term financing instead, she will pay 7.50 percent interest in the first year, 12.15 percent interest in the second year, and 8.25 percent interest in the third year. assume interest is paid in full at the end of each year. a)determine the total interest cost under each plan. a) long term fixed rate: b) short term fixed rate: b) which plan is less costly? a) long term fixed rate plan b) short term variable rate plan

Answers: 2

You know the right answer?

Use the following scenario and data for all questions During lunch time, customers arrive at a posta...

Questions

Mathematics, 04.03.2021 18:20

Mathematics, 04.03.2021 18:20

Mathematics, 04.03.2021 18:20

Advanced Placement (AP), 04.03.2021 18:20

Mathematics, 04.03.2021 18:20

Computers and Technology, 04.03.2021 18:20

Mathematics, 04.03.2021 18:20

Mathematics, 04.03.2021 18:20

Mathematics, 04.03.2021 18:20

English, 04.03.2021 18:20