Bloomberg. com - Markets

Rates & Bonds

10 Year Government Bond Yields

C...

Bloomberg. com - Markets

Rates & Bonds

10 Year Government Bond Yields

COUNTRY YIELD

United States 0.68 %

Canada 0.76 %

Mexico 7.3 0%

Switzerland -0.38%

a) Assuming that bond rating agencies, such as Moody’s and Standard & Poor’s, have rated the government bonds of the US, Canada, Switzerland, and Germany free of risk of default-with a grade of AAA - how do you explain the apparent differences between, the US bond rate on the one hand and the Swiss bond rate and the Canadian bond on the other hand? Explain the theory behind this.

(b) How do you explain the apparent difference between the US bond rate and that of Mexico’s if Mexican Bonds are ranked riskier than that of the US?

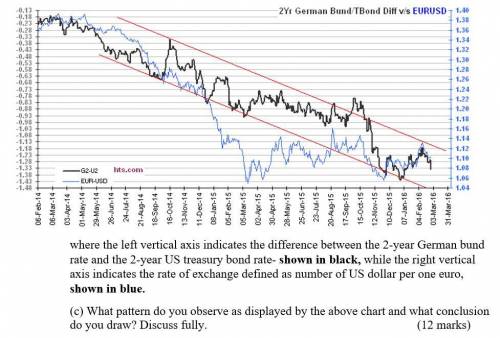

Now consider the following chart:

Answers: 2

Another question on Business

Business, 21.06.2019 23:30

Starting at age 30, you deposit $2000 a year into an ira account for retirement. treat the yearly deposits into the account as a continuous income stream. if money in the account earns 7%, compounded continuously, how much will be in the account 35 years later, when you retire at age 65? how much of the final amount is interest?

Answers: 2

Business, 22.06.2019 18:00

In which job role will you be creating e-papers, newsletters, and periodicals?

Answers: 1

Business, 22.06.2019 19:40

Aprimary advantage of organizing economic activity within firms is thea. ability to coordinate highly complex tasks to allow for specialized division of labor. b. low administrative costs because of reduced bureaucracy. c. eradication of the principal-agent problem. d. high-powered incentive to work as salaried employees for an existing firm.

Answers: 1

Business, 23.06.2019 01:30

You need $87,000 in 12 years. required: if you can earn .54 percent per month, how much will you have to deposit today?

Answers: 2

You know the right answer?

Questions

Mathematics, 02.08.2019 04:00

Spanish, 02.08.2019 04:00

Biology, 02.08.2019 04:00

English, 02.08.2019 04:00

Mathematics, 02.08.2019 04:00

Mathematics, 02.08.2019 04:00

History, 02.08.2019 04:00

Mathematics, 02.08.2019 04:00

Physics, 02.08.2019 04:00

History, 02.08.2019 04:00