Business, 15.04.2020 03:46 wbrandi118

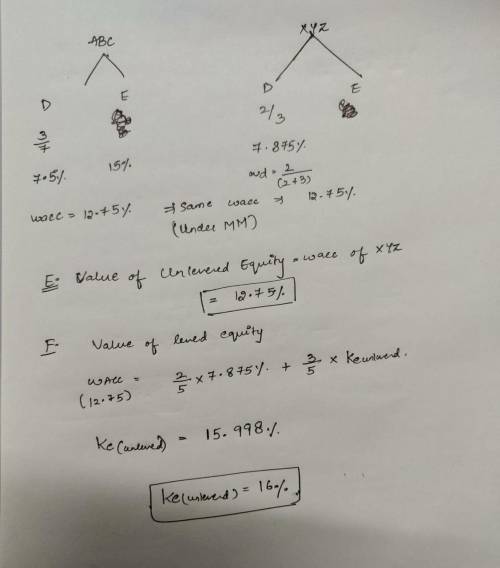

1. ABC and XYZ are two industry competitors, operating under MM perfect capital markets environment. ABC’s market-value-based Debt/Equity ratio is 3/7. Its market-value-based cost of debt, rD, is 7.5% and cost of equity, rE, is 15%. XYZ’s Debt/Equity ratio is 2/3. XYZ’s cost of debt, rD, is 7.875% A. What is the required rate of return on ABC’s assets, rA? B. What is ABC’s weighted average cost of capital (WACC)? Explain. C. What is the required rate of return on XYZ’s assets, rA? Explain. D. What is XYZ’s weighted average cost of capital (WACC)? Explain. E. What is the required rate of return on XYZ’s unlevered equity? Explain. F. What is the required rate of return on XYZ’s levered equity, rE?

Answers: 1

Another question on Business

Business, 21.06.2019 20:40

•broussard skateboard’s sales are expected to increase by 15% from $8 million in 2016 to $9.2 million in 2017. its assets totaled $5 million at the end of 2016. broussard is already at full capacity, so its assets must grow at the same rate as projected sales. at the end of 2016, current liabilities were $1.4 million, consisting of $450,000 of accounts payable, $500,000 of notes payable, and $450,000 of accruals. the after-tax profit margin is forecasted to be 6%, and the forecasted payout ratio is 40%. use the afn equation to forecast broussard’s additional funds needed for the coming year

Answers: 2

Business, 22.06.2019 11:00

The following information is available for ellen's fashions, inc. for the current month. book balance end of month $ 7 comma 000 outstanding checks 700 deposits in transit 4 comma 500 service charges 120 interest revenue 45 what is the adjusted book balance on the bank reconciliation?

Answers: 2

Business, 22.06.2019 19:30

Anew firm is developing its business plan. it will require $615,000 of assets, and it projects $450,000 of sales and $355,000 of operating costs for the first year. management is reasonably sure of these numbers because of contracts with its customers and suppliers. it can borrow at a rate of 7.5%, but the bank requires it to have a tie of at least 4.0, and if the tie falls below this level the bank will call in the loan and the firm will go bankrupt. what is the maximum debt ratio the firm can use? (hint: find the maximum dollars of interest, then the debt that produces that interest, and then the related debt ratio.)a. 41.94%b. 44.15%c. 46.47%d. 48.92%e. 51.49%

Answers: 3

Business, 22.06.2019 21:20

White truffles are a very prized and rare edible fungus that grow naturally in the countryside near alba, italy. suppose that it costs $200 per day to search for white truffles. on an average day, the total number of white truffles (t) found in alba is t = 20x − x 2 , where x is the number of people searching for white truffles on that day. white truffles can be sold for $100 each. if there is no regulation, how many more people will be searching for white truffles than the socially optimal number?

Answers: 1

You know the right answer?

1. ABC and XYZ are two industry competitors, operating under MM perfect capital markets environment....

Questions

Mathematics, 12.06.2020 19:57

Physics, 12.06.2020 19:57

Mathematics, 12.06.2020 19:57

Mathematics, 12.06.2020 19:57

History, 12.06.2020 19:57

Mathematics, 12.06.2020 19:57

Social Studies, 12.06.2020 19:57

History, 12.06.2020 19:57

Mathematics, 12.06.2020 19:57

Social Studies, 12.06.2020 19:57