Business, 15.04.2020 03:41 raveransaw

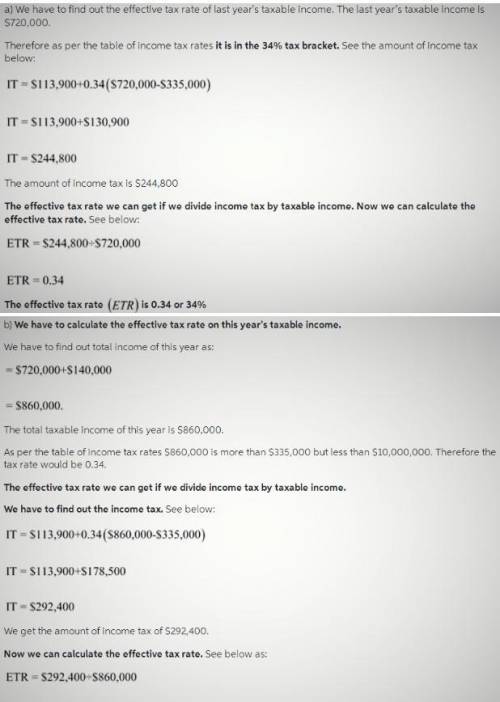

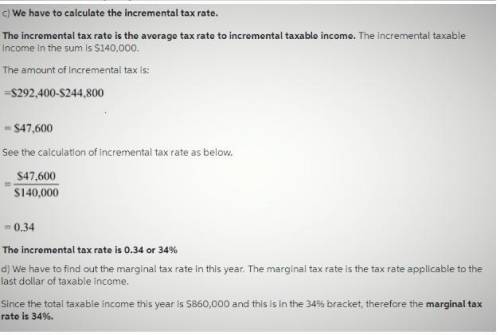

TenTec. in Sevierville, TN makes commercial and amateur radio equipment including receivers, transceivers, antenna tuners, linear amplifiers, etc. Their taxable income last year was $720,000. They have established a new line of electronic equipment that is on sale this year, and expected to add another $140,000 to taxable income. a) Determine the effective (average) tax rate on all of last year’s taxable income. b) Determine the effective (average) tax rate on all of this year’s taxable income. c) Determine the incremental tax rate. d) Determine the marginal tax rate this year.

Answers: 3

Another question on Business

Business, 22.06.2019 16:00

Winners of the georgia lotto drawing are given the choice of receiving the winning amount divided equally over 2121 years or as a lump-sum cash option amount. the cash option amount is determined by discounting the annual winning payment at 88% over 2121 years. this week the lottery is worth $1616 million to a single winner. what would the cash option payout be?

Answers: 3

Business, 22.06.2019 19:20

The following information is from the 2019 records of albert book shop: accounts receivable, december 31, 2019 $ 42 comma 000 (debit) allowance for bad debts, december 31, 2019 prior to adjustment 2 comma 000 (debit) net credit sales for 2019 179 comma 000 accounts written off as uncollectible during 2017 15 comma 000 cash sales during 2019 28 comma 500 bad debts expense is estimated by the method. management estimates that $ 5 comma 300 of accounts receivable will be uncollectible. calculate the amount of bad debts expense for 2019.

Answers: 2

Business, 22.06.2019 20:50

Happy foods and general grains both produce similar puffed rice breakfast cereals. for both companies, thecost of producing a box of cereal is 45 cents, and it is not possible for either company to lower their productioncosts any further. how can one company achieve a competitive advantage over the other?

Answers: 1

Business, 22.06.2019 20:50

Stormie zanzibar owns a bakery in the fictitious country of olombia. each month the government’s market ministry mails her a large list of the regulated price of goods which include products like bread, muffins and flat bread. the list also dictates the types of goods she can sell at the bakery and what she is to charge. because of the regulations placed on these goods, stormie has increased her production of sweets, pies, cakes, croissants and buns and decreased her supply of breads, muffins and flat bread. she has taken these steps because the sweet goods’ prices are not government controlled. stormie zanzibar lives under what type of economy?

Answers: 3

You know the right answer?

TenTec. in Sevierville, TN makes commercial and amateur radio equipment including receivers, transce...

Questions

Biology, 10.03.2021 22:40

World Languages, 10.03.2021 22:40

Mathematics, 10.03.2021 22:40

Geography, 10.03.2021 22:40

Mathematics, 10.03.2021 22:40

English, 10.03.2021 22:40

Mathematics, 10.03.2021 22:40