Business, 08.04.2020 04:24 lovelyheart5337

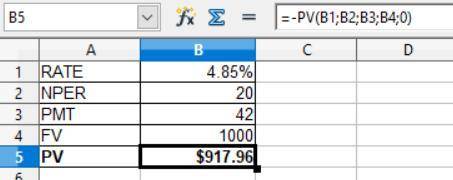

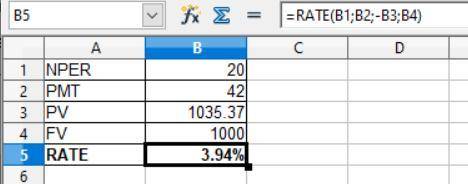

Suppose a ten-year, $ 1 comma 000 bond with an 8.4 % coupon rate and semiannual coupons is trading for $ 1 comma 035.37. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. If the bond's yield to maturity changes to 9.7 % APR, what will be the bond's price?

Answers: 3

Another question on Business

Business, 22.06.2019 01:30

Juwana was turned down for a car loan by a local credit union she thought her credit was good what should her first step be

Answers: 1

Business, 22.06.2019 04:10

Oakmont company has an opportunity to manufacture and sell a new product for a four-year period. the company’s discount rate is 18%. after careful study, oakmont estimated the following costs and revenues for the new product: cost of equipment needed $ 230,000 working capital needed $ 84,000 overhaul of the equipment in year two $ 9,000 salvage value of the equipment in four years $ 12,000 annual revenues and costs: sales revenues $ 400,000 variable expenses $ 195,000 fixed out-of-pocket operating costs $ 85,000 when the project concludes in four years the working capital will be released for investment elsewhere within the company. click here to view exhibit 12b-1 and exhibit 12b-2, to determine the appropriate discount factor(s) using tables.

Answers: 2

Business, 22.06.2019 05:30

U.s. internet advertising revenue grew at the rate of r(t) = 0.82t + 1.14 (0 ≤ t ≤ 4) billion dollars/year between 2002 (t = 0) and 2006 (t = 4). the advertising revenue in 2002 was $5.9 billion.† (a) find an expression f(t) giving the advertising revenue in year t.

Answers: 1

Business, 22.06.2019 07:30

Which two of the following are benefits of consumer programs

Answers: 1

You know the right answer?

Suppose a ten-year, $ 1 comma 000 bond with an 8.4 % coupon rate and semiannual coupons is trading f...

Questions

Mathematics, 15.07.2019 03:00

Social Studies, 15.07.2019 03:00

Computers and Technology, 15.07.2019 03:00

Mathematics, 15.07.2019 03:00

Social Studies, 15.07.2019 03:00