Business, 08.04.2020 00:50 zriggi2528

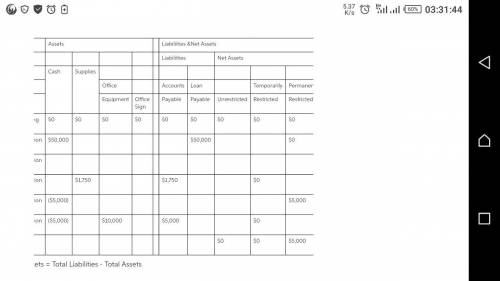

Shanna Engel started up a new nonprofit organization in 2013 named Concern for Animal Shelter and Habitats (CASH). The organization places homeless animals in permanent homes. Transactions during the first month of operations were as follows:

1. Borrowed $ 50,000 from a local bank. No interest is due on the loan during the first month, and the principal does not have to be paid back for two years.

2. Signed a contract with a local carpenter to build a fence to enclose the backyard. The carpenter charges $ 250 per hour and expects the fence to take 10 hours to complete. He expects to begin work next month.

3. CASH bought 50 bags of dog food and 25 bags of cat food. Dog food costs $ 20 per bag, while cat food costs $ 30 per bag. The pet food was bought on credit (i. e., CASH has not yet paid for the supplies).

4. CASH bought a sign to hang in front of its building. The sign cost $ 5,000 and CASH paid for it when it was received.

5. Purchased and received an office computer, server, printer, and copier. The total cost of the equipment was $ 10,000, half of which was paid and the other half was still owed.

Show the impact of these transactions on the fundamental equation of accounting.

Answers: 1

Another question on Business

Business, 21.06.2019 13:50

Dodd corporation uses the weighted-average method in its process costing system. this month, the beginning inventory in the first processing department consisted of 400 units. the costs and percentage completion of these units in beginning inventory were:

Answers: 1

Business, 21.06.2019 14:00

In the context of your career choice, your own business skills cannot influence the level of your personal financial success. a. true b. false

Answers: 2

Business, 22.06.2019 14:20

Cardinal company is considering a project that would require a $2,725,000 investment in equipment with a useful life of five years. at the end of five years, the project would terminate and the equipment would be sold for its salvage value of $400,000. the company’s discount rate is 14%. the project would provide net operating income each year as follows: sales $2,867,000 variable expenses 1,125,000 contribution margin 1,742,000 fixed expenses: advertising, salaries, and other fixed out-of-pocket costs $706,000 depreciation 465,000 total fixed expenses 1,171,000 net operating income $571,000 1. which item(s) in the income statement shown above will not affect cash flows? (you may select more than one answer. single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. any boxes left with a question mark will be automatically graded as incorrect.) (a)sales (b)variable expenses (c) advertising, salaries, and other fixed out-of-pocket costs expenses (d) depreciation expense 2. what are the project’s annual net cash inflows? 3.what is the present value of the project’s annual net cash inflows? (use the appropriate table to determine the discount factor(s) and final answer to the nearest dollar amount.) 4.what is the present value of the equipment’s salvage value at the end of five years? (use the appropriate table to determine the discount factor(s) and final answer to the nearest dollar amount.) 5.what is the project’s net present value? (use the appropriate table to determine the discount factor(s) and final answer to the nearest dollar amount.)

Answers: 2

Business, 22.06.2019 14:50

Pederson company reported the following: manufacturing costs $480,000 units manufactured 8,000 units sold 7,500 units sold for $90 per unit beginning inventory 2,000 units what is the average manufacturing cost per unit? (round the answer to the nearest dollar.)

Answers: 3

You know the right answer?

Shanna Engel started up a new nonprofit organization in 2013 named Concern for Animal Shelter and Ha...

Questions

Biology, 10.07.2019 00:00

English, 10.07.2019 00:00

Mathematics, 10.07.2019 00:00

History, 10.07.2019 00:00

Biology, 10.07.2019 00:00

History, 10.07.2019 00:00

Physics, 10.07.2019 00:00

Biology, 10.07.2019 00:00

Biology, 10.07.2019 00:00

Chemistry, 10.07.2019 00:00

Mathematics, 10.07.2019 00:00