Inverness Steel Corporation is a producer of flat-rolled carbon, stainless and electrical steels, and tubular products. The company's income statement for the 2016 fiscal year reported the following information ($ in millions):

Sales $ 6,100

Cost of goods sold 5,100

The company's balance sheets for 2016 and 2015 included the following information ($ in millions):

2016 2015

Current assets:

Accounts receivable, net $ 702 $ 602

Inventories 890 814

The statement of cash flows reported bad debt expense for 2016 of $6 million. The summary of significant accounting policies included the following notes ($ in millions):

Accounts Receivable (in part)

The allowance for uncollectible accounts was $8 and $5 at December 31, 2016 and 2015, respectively. All sales are on credit.

Inventories

Inventories are valued at the lower of cost or market. The cost of the majority of inventories is measured using the last in, first out (LIFO) method. Other inventories are measured principally at average cost and consist mostly of foreign inventories and certain raw materials. If the entire inventory had been valued on an average cost basis, inventory would have been higher by $460 and $310 at the end of 2016 and 2015, respectively.

During 2016, 2015, and 2014, liquidation of LIFO layers generated income of $4, $5, and $23, respectively.

Required:

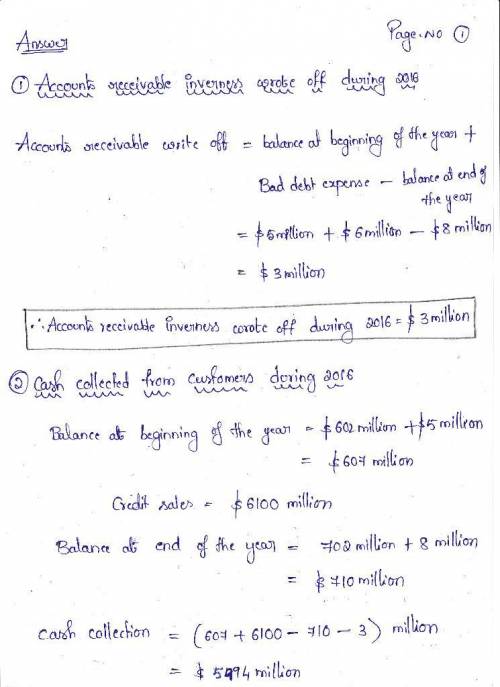

1.

Determine the amount of accounts receivable Inverness wrote off during 2016. (Enter your answer in millions.)

2.

Calculate the amount of cash collected from customers during 2016. (Enter your answer in millions.)

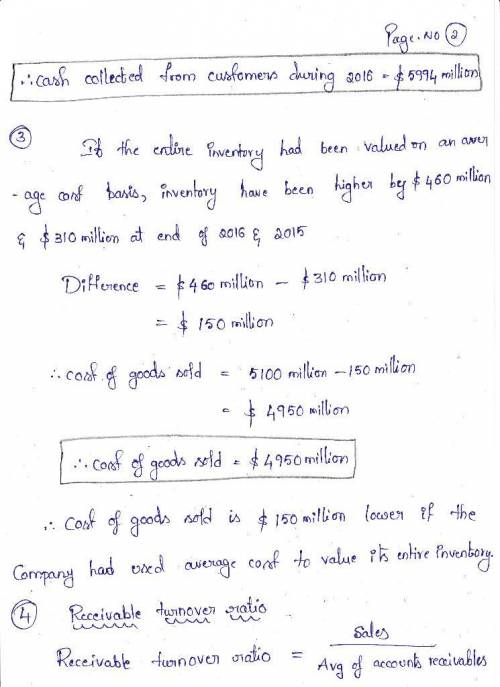

3.

Calculate what cost of goods sold would have been for 2016 if the company had used average cost to val

4.

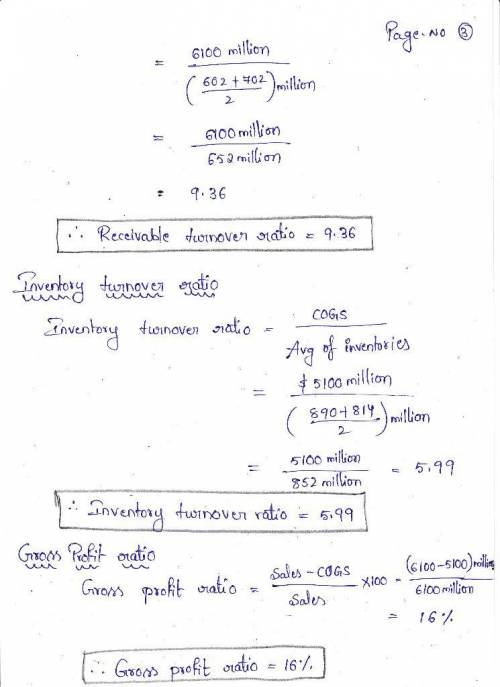

Calculate the following ratios for 2016. (Round "Receivables turnover ratio" and "Inventory turnover ratio" answers to 2 decimal places. Round "Gross profit ratio" answer to nearest percent (i. e., 0.123 needs to be entered as 12%).)

ue its entire inventory. (Enter your answer in millions.)

Answers: 3

Another question on Business

Business, 22.06.2019 01:20

What cylinder head operation is the technician performing in this figure?

Answers: 1

Business, 22.06.2019 06:00

Transactions on april 1 of the current year, andrea byrd established a business to manage rental property. she completed the following transactions during april: opened a business bank account with a deposit of $45,000 from personal funds. purchased office supplies on account, $2,000. received cash from fees earned for managing rental property, $8,500. paid rent on office and equipment for the month, $5,000. paid creditors on account, $1,375. billed customers for fees earned for managing rental property, $11,250. paid automobile expenses for month, $840, and miscellaneous expenses, $900. paid office salaries, $3,600. determined that the cost of supplies on hand was $550; therefore, the cost of supplies used was $1,450. withdrew cash for personal use, $2,000. required: 1. indicate the effect of each transaction and the balances after each transaction: for those boxes in which no entry is required, leave the box blank. for those boxes in which you must enter subtractive or negative numbers use a minus sign. (example: -300)

Answers: 1

Business, 22.06.2019 09:00

Afood worker has just rinsed a dish after cleaning it.what should he do next?

Answers: 2

Business, 22.06.2019 12:40

Acompany has $80,000 in outstanding accounts receivable and it uses the allowance method to account for uncollectible accounts. experience suggests that 6% of outstanding receivables are uncollectible. the current credit balance (before adjustments) in the allowance for doubtful accounts is $1,200. the journal entry to record the adjustment to the allowance account includes a debit to bad debts expense for $4,800. true or false

Answers: 3

You know the right answer?

Inverness Steel Corporation is a producer of flat-rolled carbon, stainless and electrical steels, an...

Questions

Mathematics, 16.11.2019 19:31

Mathematics, 16.11.2019 19:31

History, 16.11.2019 19:31

Mathematics, 16.11.2019 19:31

History, 16.11.2019 19:31

History, 16.11.2019 19:31

History, 16.11.2019 19:31

Health, 16.11.2019 19:31