Business, 08.04.2020 00:16 jeniferfayzieva2018

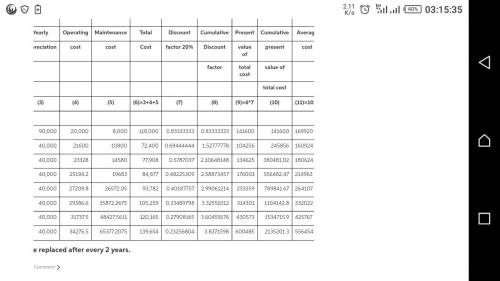

Milliken uses a digitally controlled "dyer" for placing intricate and integrated patterns on manufactured carpet squares for home and commercial use. It is purchased for $400,000. Its market value will be $310,000 at the end of the fi rst year and drop by $40,000 per year thereafter to a minimum of $30,000. Operating costs are $20,000 the fi rst year, increasing by 8% per year. Maintenance costs are only $8,000 the fi rst year but will increase by 35% each year thereafter. Milliken’s MARR is 20%. Determine the optimum replacement interval for the dyer.

Answers: 2

Another question on Business

Business, 22.06.2019 00:00

Alandlord rented an art studio to an artist. under the terms of the signed, written, two-year lease, the artist agreed to pay the landlord $1,000 per month and to assume responsibility for all necessary repairs. after the first year of the lease, the artist assigned the balance of his lease to a sculptor. the landlord approved the sculptor as a tenant and accepted two rent payments from her, and then the landlord sold the building to an investor. the sculptor had made two payments to the investor when an electrical fire broke out in the studio, injuring the sculptor. the fire was caused by faulty wiring. the landlord was aware that there was a dangerous wiring problem when he leased the property to the artist. but when the landlord discovered how costly repairs would be, he decided it would be more profitable to sell the property than to repair it. the problem was not easily discoverable by anyone other than an expert electrician, and the landlord did not tell the artist, the sculptor, or the investor about the problem. the sculptor sues to recover damages for her injuries. from whom can the sculptor recover?

Answers: 3

Business, 22.06.2019 06:30

If a seller prepaid the taxes of $4,400 and the closing is set for may 19, using the 12 month/30 day method what will the buyer owe the seller as prorated taxes?

Answers: 1

Business, 22.06.2019 15:30

Uknow what i love about i ask a dumb question it is immediately answered but when i ask a real question it take like an hour to get answered

Answers: 2

Business, 22.06.2019 20:10

Russell's is considering purchasing $697,400 of equipment for a four-year project. the equipment falls in the five-year macrs class with annual percentages of .2, .32, .192, .1152, .1152, and .0576 for years 1 to 6, respectively. at the end of the project the equipment can be sold for an estimated $135,000. the required return is 13.2 percent and the tax rate is 23 percent. what is the amount of the aftertax salvage value of the equipment assuming no bonus depreciation is taken

Answers: 2

You know the right answer?

Milliken uses a digitally controlled "dyer" for placing intricate and integrated patterns on manufac...

Questions

Biology, 21.12.2019 12:31

Social Studies, 21.12.2019 12:31

Arts, 21.12.2019 12:31

Mathematics, 21.12.2019 12:31

World Languages, 21.12.2019 12:31

Biology, 21.12.2019 12:31

Social Studies, 21.12.2019 12:31

Spanish, 21.12.2019 12:31

Mathematics, 21.12.2019 12:31

History, 21.12.2019 12:31

Chemistry, 21.12.2019 12:31

Geography, 21.12.2019 12:31