Business, 06.04.2020 23:29 dianamachado14

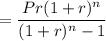

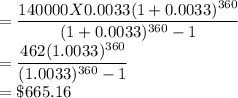

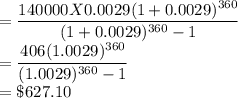

You need a loan of ​$140,000 to buy a home. Calculate your monthly payments and total closing costs for each choice below. Briefly discuss how you would decide between the two choices.

Choice​ 1: 30 ​-year fixed rate at 4 ​% with closing costs of ​$2100 and no points.

Choice​ 2: 30 ​-year fixed rate at 3.5 ​% with closing costs of ​$2100 and 4 points.

What is the monthly payment for choice​ 1? ​$ ​(Do not round until the final answer. Then round to the nearest cent as​ needed.)

What is the monthly payment for choice​ 2? ​$ ​(Do not round until the final answer. Then round to the nearest cent as​ needed.)

What is the total closing cost for choice​ 1? $

What is the total closing cost for choice​ 2? ​$

Why might choice 1 be the better​ choice?

A. The monthly payment is higher.

B. The monthly payment is lower.

C. The closing costs are lower.

D. The closing costs are higher.

Why might choice 2 be the better​ choice?

A. The closing costs are higher.

B. The closing costs are lower.

C. The monthly payment is higher.

D. The monthly payment is lower.

Answers: 3

Another question on Business

Business, 22.06.2019 10:20

The different concepts in the architecture operating model are aligned with how the business chooses to integrate and standardize with an enterprise solution. in the the technology solution shares data across the enterprise.

Answers: 3

Business, 22.06.2019 12:30

Consider a treasury bill with a rate of return of 5% and the following risky securities: security a: e(r) = .15; variance = .0400 security b: e(r) = .10; variance = .0225 security c: e(r) = .12; variance = .1000 security d: e(r) = .13; variance = .0625 the investor must develop a complete portfolio by combining the risk-free asset with one of the securities mentioned above. the security the investor should choose as part of her complete portfolio to achieve the best cal would be a. security a b. security b c. security c d. security d

Answers: 3

Business, 22.06.2019 15:10

You want to have $80,000 in your savings account 11 years from now, and you’re prepared to make equal annual deposits into the account at the end of each year. if the account pays 6.30 percent interest, what amount must you deposit each year? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Answers: 1

Business, 22.06.2019 23:00

Ernesto baca is employed by bigg company. he has a family membership in his company's health insurance program. the annual premium is $5,432. ernesto's employer pays 80% of the total cost. ernesto's contribution is deducted from his paycheck. what is his annual contribution? $1,086.40 $1,125.65 $1,527.98 $1,567.20 save and exit

Answers: 3

You know the right answer?

You need a loan of ​$140,000 to buy a home. Calculate your monthly payments and total closing cost...

Questions

English, 06.11.2020 09:30

Chemistry, 06.11.2020 09:30

Biology, 06.11.2020 09:30

Mathematics, 06.11.2020 09:30

Biology, 06.11.2020 09:30

English, 06.11.2020 09:30

Biology, 06.11.2020 09:30

Biology, 06.11.2020 09:30

History, 06.11.2020 09:30

Mathematics, 06.11.2020 09:30

History, 06.11.2020 09:30

Mathematics, 06.11.2020 09:30