Business, 06.04.2020 22:37 emojilover8188

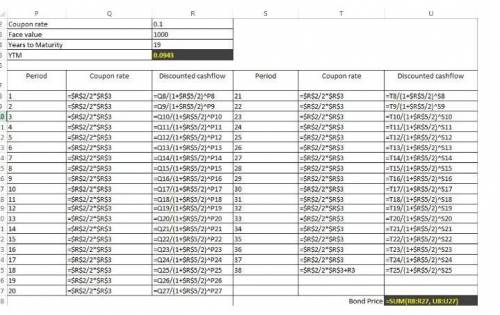

Chamberlain Co. wants to issue new 19-year bonds for some much-needed expansion projects. The company currently has 10 percent coupon bonds on the market that sell for $1,050, make semiannual payments, and mature in 19 years. What coupon rate should the company set on its new bonds if it wants them to sell at par

Answers: 1

Another question on Business

Business, 21.06.2019 22:20

On january 1, jackson, inc.'s work-process inventory account showed a balance of $ 66,500. during the year, materials requisitioned for use in production amounted to $ 70,500, of which $ 67,700 represented direct materials. factory wages for the period were $ 210,000 of which $ 187,000 were for direct labor. manufacturing overhead is allocated on the basis of 60% of direct labor cost. actual overhead was $ 116,050. jobs costing $ 353,060 were completed during the year. the december 31 balance in work-process inventory is

Answers: 1

Business, 22.06.2019 19:20

Six years ago, an 80-kw diesel electric set cost $160,000. the cost index for this class of equipment six years ago was 187 and is now 194. the cost-capacity factor is 0.6. the plant engineering staff is considering a 120-kw unit of the same general design to power a small isolated plant. assume we want to add a precompressor, which (when isolated and estimated separately) currently costs $13291. determine the total cost of the 120-kw unit. (hint: skip $ and comma symbols)

Answers: 3

Business, 22.06.2019 19:40

The common stock of ncp paid $1.35 in dividends last year. dividends are expected to grow at an annual rate of 5.30 percent for an indefinite number of years. a. if ncp's current market price is $22.57 per share, what is the stock's expected rate of return? b. if your required rate of return is 7.3 percent, what is the value of the stock for you? c. should you make the investment? a. if ncp's current market price is $22.57 per share, the stock's expected rate of return is

Answers: 3

Business, 22.06.2019 20:00

Afirm is producing at minimum average total cost with its current plant. draw the firm's long-run average cost curve. label it. draw a point on the lrac curve at which the firm cannot lower its average total cost. draw the firm's short-run average total cost curve that is consistent with the point you have drawn. label it.g

Answers: 2

You know the right answer?

Chamberlain Co. wants to issue new 19-year bonds for some much-needed expansion projects. The compan...

Questions

Chemistry, 25.09.2020 03:01

Biology, 25.09.2020 03:01

Mathematics, 25.09.2020 03:01

Arts, 25.09.2020 03:01

Mathematics, 25.09.2020 03:01

Mathematics, 25.09.2020 03:01

Mathematics, 25.09.2020 03:01

Mathematics, 25.09.2020 03:01

Mathematics, 25.09.2020 03:01