Business, 06.04.2020 19:39 davechucktaylor

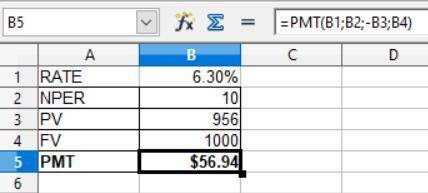

Item3 0.5 points eBookPrintReferences Check my work Check My Work button is now enabledItem 3Item 3 0.5 points Problem 7-5 Coupon Rates [LO2] Gabriele Enterprises has bonds on the market making annual payments, with ten years to maturity, a par value of $1,000, and selling for $956. At this price, the bonds yield 6.3 percent. What must the coupon rate be on the bonds

Answers: 1

Another question on Business

Business, 22.06.2019 06:30

If a seller prepaid the taxes of $4,400 and the closing is set for may 19, using the 12 month/30 day method what will the buyer owe the seller as prorated taxes?

Answers: 1

Business, 22.06.2019 17:20

Andy owns islander surfboard inc. in the past, andy has always given his employees bonuses during the holidays if they reached certain sales goals. this year, even though the company is thriving, he decided to cut bonuses from employees and award them to himself instead. what ethical theory of leadership is andy following?

Answers: 1

Business, 22.06.2019 17:30

Which curve shows increasing opportunity cost as you give up more of one option? demand curve bow-shaped curve yield curve indifference curve

Answers: 3

Business, 22.06.2019 20:40

Aggart technologies is considering issuing new common stock and using the proceeds to reduce its outstanding debt. the stock issue would have no effect on total assets, the interest rate taggart pays, ebit, or the tax rate. which of the following is likely to occur if the company goes ahead with the stock issue? a. the roa will decline.b. taxable income will decline.c. the tax bill will increase.d. net income will decrease.e. the times-interest-earned ratio will decrease

Answers: 1

You know the right answer?

Item3 0.5 points eBookPrintReferences Check my work Check My Work button is now enabledItem 3Item 3...

Questions

Business, 18.11.2019 02:31

Mathematics, 18.11.2019 02:31

Business, 18.11.2019 02:31

Spanish, 18.11.2019 02:31

Mathematics, 18.11.2019 02:31

Mathematics, 18.11.2019 02:31

Mathematics, 18.11.2019 02:31