Business, 04.04.2020 11:33 denjayjr681

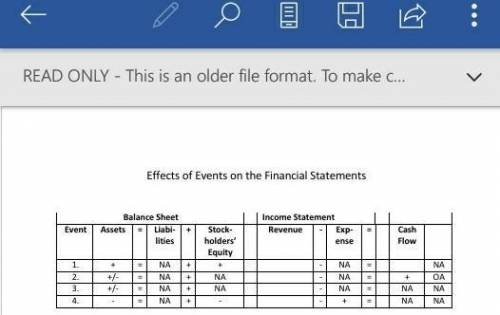

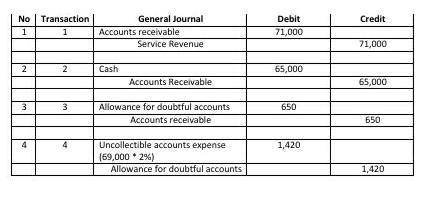

Exercise 7-5A Analyzing financial statement effects of accounting for uncollectible accounts using the percent of revenue allowance method LO 7-1 Grover Inc. uses the allowance method to account for uncollectible accounts expense. Grover, Inc. experienced the following four accounting events in Year 1: Recognized $71,000 of revenue on account. Collected $65,000 cash from accounts receivable. Wrote off uncollectible accounts of $650. Recognized uncollectible accounts expense. Grover estimated that uncollectible accounts expense will be 2 percent of sales on account.

Answers: 3

Another question on Business

Business, 22.06.2019 10:20

Asmartphone manufacturing company uses social media to achieve different business objectives. match each social media activity of the company to the objective it the company achieve.

Answers: 2

Business, 22.06.2019 15:20

On january 2, 2018, bering co. disposes of a machine costing $34,100 with accumulated depreciation of $18,369. prepare the entries to record the disposal under each of the following separate assumptions. exercise 8-24a part 2 2. the machine is traded in for a newer machine having a $50,600 cash price. a $16,238 trade-in allowance is received, and the balance is paid in cash. assume the asset exchange has commercial substance.

Answers: 2

Business, 23.06.2019 05:10

To use google as main search engine, which internet browser can i use

Answers: 2

You know the right answer?

Exercise 7-5A Analyzing financial statement effects of accounting for uncollectible accounts using t...

Questions

Mathematics, 09.12.2020 22:00

Mathematics, 09.12.2020 22:00

Mathematics, 09.12.2020 22:00

Mathematics, 09.12.2020 22:00

History, 09.12.2020 22:00