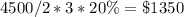

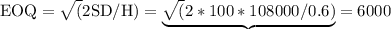

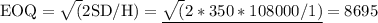

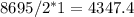

Drugs Online (DO) is an online retailer of prescription drugs and health supplements. Vitamins represent a significant percentage of its sales. Demand for vitamins is 9,000 bottles per month. DO incurs a fixed order placement and receiving cost of $100 each time an order for vitamins is placed with the manufacturer. The purchase price is $3.00 per bottle. DO incurs a holding cost of 20 percent per year. (Assume 30 days a month.) a and b: Retailer Part a) Assume that DO places an order for 4,500 bottles every 15 days. Compute the annual ordering and holding cost for the current ordering policy. Part b) What is the optimal order quantity to minimize the annual ordering and holding cost? Part (c) The manufacturer: Now consider the manufacturer of vitamins who supplies DO. The manufacturer has a production line dedicated for producing vitamins supplied to DO. This line produces 9,000 bottles per month at a daily constant rate of 300 per day. The variable manufacturing cost is $2 per bottle. Manufacturer incurs a fixed cost of $250 to process, pack, and ship an order to DO. The holding cost is 20% year. Compute the following if DO’s order size is 4,500 bottles. Assume that the manufacturer’s inventory falls to zero when a batch of 4,500 bottles is shipped to DO. (i) Manufacturer’s average inventory: (ii) Number of orders manufacturer fills per year (iii) Manufacturer’s annual cost of holding inventory and filling orders: Part (d) for the supply chain: Now consider the supply chain that consists of both the manufacturer and DO. (i) For order sizes of 4,500 by the DO to the manufacturer, write the annual inventory holding and order cost for the supply chain. [Hint: It is sum of cost in part a and c(iii).] (ii) Find the optimal order size by DO to the manufacturer in order to minimize the annual inventory holding and order cost for the supply chain

Answers: 1

Another question on Business

Business, 22.06.2019 12:50

Jallouk corporation has two different bonds currently outstanding. bond m has a face value of $50,000 and matures in 20 years. the bond makes no payments for the first six years, then pays $2,100 every six months over the subsequent eight years, and finally pays $2,400 every six months over the last six years. bond n also has a face value of $50,000 and a maturity of 20 years; it makes no coupon payments over the life of the bond. the required return on both these bonds is 10 percent compounded semiannually. what is the current price of bond m and bond n?

Answers: 3

Business, 22.06.2019 14:30

If a product goes up in price, and the demand for it drops, that product's demand is a. elastic b. inelastic c. stable d. fixed select the best answer from the choices provided

Answers: 1

Business, 22.06.2019 22:30

Ellen and george work for the same company. ellen, a gen xer, really appreciates the flextime opportunities, while george, a baby boomer, takes advantage of the free computer training offered at the company. these policies are examples of

Answers: 3

Business, 23.06.2019 05:20

What is difference between fiscal year and tax year? explain in the simplest way.

Answers: 1

You know the right answer?

Drugs Online (DO) is an online retailer of prescription drugs and health supplements. Vitamins repre...

Questions

English, 07.11.2019 05:31

Mathematics, 07.11.2019 05:31

Computers and Technology, 07.11.2019 05:31

English, 07.11.2019 05:31

Mathematics, 07.11.2019 05:31

Chemistry, 07.11.2019 05:31

Mathematics, 07.11.2019 05:31

Mathematics, 07.11.2019 05:31