Business, 30.03.2020 23:58 preguntassimples

The following is a free response question released by the College Board from a previous AP exam to be used as practice for future exams. You can complete the assignment in this document, using the drawing tools in Word (or any photo editing program) or print this document, and complete the activity by hand, submitting a scan or photo of your work. When you are done, submit the assignment for grading by your instructor. This question will be graded out of 7 points.

1. Assume that two firms are operating with identical cost schedules, but one firm is in a perfectly competitive industry and the other is in a monopolistically competitive industry.

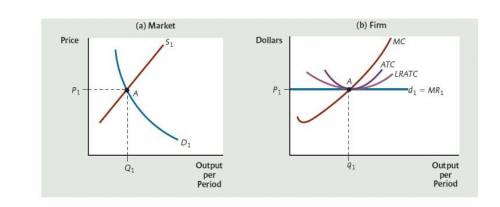

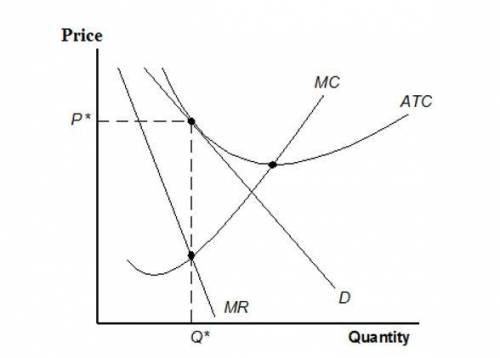

(a) Using two correctly labeled graphs, show the long-run equilibrium price and output levels for each of these two firms.

(b) Compare the long-run equilibrium price and output levels for these two firms.

(c) What level of economic profit will each firm earn in the long run? Why do these results occur?

(d) For each of the two firms at the equilibrium quantity, indicate whether the firm’s demand curve is perfectly elastic, inelastic, unit elastic, inelastic, or perfectly inelastic. How can you tell?

Answers: 3

Another question on Business

Business, 22.06.2019 01:40

Select the word from the list that best fits the definition sometimes

Answers: 2

Business, 22.06.2019 10:40

Parks corporation is considering an investment proposal in which a working capital investment of $10,000 would be required. the investment would provide cash inflows of $2,000 per year for six years. the working capital would be released for use elsewhere when the project is completed. if the company's discount rate is 10%, the investment's net present value is closest to (ignore income taxes) ?

Answers: 1

Business, 22.06.2019 16:00

Arnold rossiter is a 40-year-old employee of the barrington company who will retire at age 60 and expects to live to age 75. the firm has promised a retirement income of $20,000 at the end of each year following retirement until death. the firm's pension fund is expected to earn 7 percent annually on its assets and the firm uses 7% to discount pension benefits. what is barrington's annual pension contribution to the nearest dollar for mr. rossiter? (assume certainty and end-of-year cash flows.)

Answers: 2

Business, 22.06.2019 18:00

1. what is the amount of interest earned after two years on a $100 deposit paying 4 percent simple interest annually? $8.00 $4.08 $8.16 $4.00 2. what is the amount of compound interest earned after three years on a $100 deposit paying 8 percent interest annually? $24.00 $8.00 $16.64 $25.97 3. a business just took out a loan for $100,000 at 10% interest. if the business pays the loan off in three months, how much did the business pay in interest? $2,500.00 $10.00 $250.00 $10,000.00 4. what is the annual percentage yield (apy) for a deposit paying 5 percent interest with monthly compounding? 5.00% 5.12% 79.59% 0.42%

Answers: 1

You know the right answer?

The following is a free response question released by the College Board from a previous AP exam to b...

Questions

Computers and Technology, 15.04.2021 17:00

English, 15.04.2021 17:00

Computers and Technology, 15.04.2021 17:00

Mathematics, 15.04.2021 17:00

Chemistry, 15.04.2021 17:00

Mathematics, 15.04.2021 17:00

History, 15.04.2021 17:00

English, 15.04.2021 17:00