Business, 28.03.2020 01:57 taylorlindsey9329

Consider three bonds with 5.50% coupon rates, all making annual coupon payments and all selling at face value. The short-term bond has a maturity of 4 years, the intermediate-term bond has a maturity of 8 years, and the long-term bond has a maturity of 30 years.

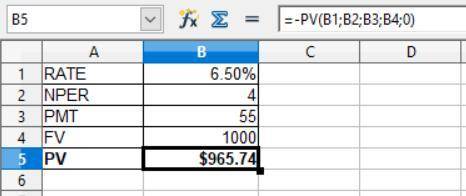

a. What will be the price of the 4-year bond if its yield increases to 6.50%?

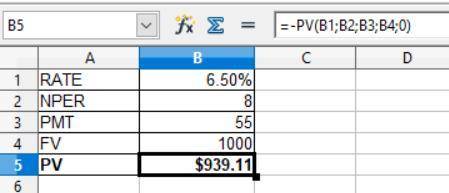

b. What will be the price of the 8-year bond if its yield incrteases to 6.50%?

Answers: 1

Another question on Business

Business, 21.06.2019 14:40

The owners of spokes bicycle shop worry that cash flow this winter may be insufficient to meet the current operating expenses. while they anticipate a surplus of cash inflow as warm weather approaches, they need funds now to meet the company's immediate obligations. the owners can best resolve cash flow concerns by obtaining financing.

Answers: 3

Business, 21.06.2019 15:30

Marvin wrote a check of $58.25 for the water bill and $450 for rent. he also made a deposit of $124.16. how much is his new balance after writing the checks and making the deposit?

Answers: 3

Business, 22.06.2019 19:00

Describe how to write a main idea expressed as a bottom-line statement

Answers: 3

Business, 22.06.2019 23:10

The direct labor budget of yuvwell corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours: 1st quarter 2nd quarter 3rd quarter 4th quarterbudgeted direct labor-hours 11,200 9,800 10,100 10,900the company uses direct labor-hours as its overhead allocation base. the variable portion of its predetermined manufacturing overhead rate is $6.00 per direct labor-hour and its total fixed manufacturing overhead is $80,000 per quarter. the only noncash item included in fixed manufacturing overhead is depreciation, which is $20,000 per quarter.required: 1. prepare the company’s manufacturing overhead budget for the upcoming fiscal year.2. compute the company’s predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year.

Answers: 3

You know the right answer?

Consider three bonds with 5.50% coupon rates, all making annual coupon payments and all selling at f...

Questions

English, 01.08.2019 02:00

Physics, 01.08.2019 02:00

Social Studies, 01.08.2019 02:00

Mathematics, 01.08.2019 02:00

Computers and Technology, 01.08.2019 02:00

Business, 01.08.2019 02:00

History, 01.08.2019 02:00

English, 01.08.2019 02:00