Business, 27.03.2020 23:18 maskythegamer

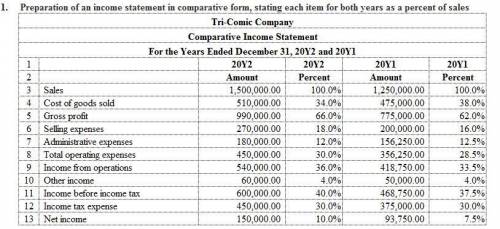

For 20Y2, Tri-Comic Company initiated a sales promotion campaign that included the expenditure of an additional $18,000 for advertising. At the end of the year, Lumi Neer, the president, is presented with the following condensed comparative income statement:

Tri-Comic Company

Comparative Income Statement

For the Years Ended December 31, 20Y2 and 20Y1

1

20Y2

20Y1

2

Sales

$1,500,000.00

$1,250,000.00

3

Cost of goods sold

510,000.00

475,000.00

4

Gross profit

$990,000.00

$775,000.00

5

Selling expenses

$270,000.00

$200,000.00

6

Administrative expenses

180,000.00

156,250.00

7

Total operating expenses

$450,000.00

$356,250.00

8

Income from operations

$540,000.00

$418,750.00

9

Other income

60,000.00

50,000.00

10

Income before income tax

$600,000.00

$468,750.00

11

Income tax expense

450,000.00

375,000.00

12

Net income

$150,000.00

$93,750.00

1. Prepare a comparative income statement for the two-year period, presenting an analysis of each item in relationship to sales for each of the years. Round your percentages to one decimal place. Enter all amounts as positive numbers.

2. To the extent the data permit, comment on the significant relationships revealed by the vertical analysis prepared in (1).

Answers: 1

Another question on Business

Business, 22.06.2019 15:00

Which of the following is least likely to a team solve problems together

Answers: 1

Business, 23.06.2019 12:00

An increase in mexico’s demand for united states goods would cause the value of the dollar to

Answers: 1

Business, 23.06.2019 15:00

Alamar petroleum company offers its employees the option of contributing retirement funds up to 5% of their wages or salaries, with the contribution being matched by alamar. the company also pays 80% of medical and life insurance premiums. deductions relating to these plans and other payroll information for the first biweekly payroll period of february are listed as follows: wages and salaries $ 2,800,000 employee contribution to voluntary retirement plan 92,000 medical insurance premiums 50,000 life insurance premiums 9,800 federal income taxes to be withheld 480,000 local income taxes to be withheld 61,000 payroll taxes: federal unemployment tax rate 0.60 % state unemployment tax rate (after futa deduction) 5.40 % social security tax rate 6.20 % medicare tax rate 1.45 % required: prepare the appropriate journal entries to record salaries and wages expense and payroll tax expense for the biweekly pay period. assume that no employee's cumulative wages exceed the relevant wage bases for social security, and that all employees' cumulative wages do exceed the relevant unemployment wage bases.

Answers: 3

You know the right answer?

For 20Y2, Tri-Comic Company initiated a sales promotion campaign that included the expenditure of an...

Questions

Mathematics, 10.03.2021 21:20

History, 10.03.2021 21:20

English, 10.03.2021 21:20

Mathematics, 10.03.2021 21:20

Mathematics, 10.03.2021 21:20

Mathematics, 10.03.2021 21:20

Mathematics, 10.03.2021 21:20

Chemistry, 10.03.2021 21:20

History, 10.03.2021 21:20