Business, 25.03.2020 23:11 michellerosas

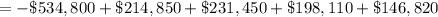

An investment has an installed cost of $534,800. The cash flows over the four-year life of the investment are projected to be $214,850, $231,450, $198,110, and $146,820. If the discount rate is zero, what is the NPV? (Omit $ sign in your response.) NPV

Answers: 1

Another question on Business

Business, 22.06.2019 08:00

Interest is credited to a fixed annuity no lower than the variable contract rate contract guaranteed rate current rate of inflation prime rate

Answers: 2

Business, 22.06.2019 11:00

Factors like the unemployment rate,the stock market,global trade,economic policy,and the economic situation of other countries have no influence on the financial status of individuals. true or false

Answers: 1

Business, 22.06.2019 12:30

Rossdale co. stock currently sells for $68.91 per share and has a beta of 0.88. the market risk premium is 7.10 percent and the risk-free rate is 2.91 percent annually. the company just paid a dividend of $3.57 per share, which it has pledged to increase at an annual rate of 3.25 percent indefinitely. what is your best estimate of the company's cost of equity?

Answers: 1

Business, 22.06.2019 22:30

When the price is the equilibrium price, we would expect there to be a causing the market to put pressure on the price until it went back to the equilibrium price. a. above; surplus; upward b. above; shortage; downward c. below; surplus; upward d. below; shortage; downward e. above; surplus; downward?

Answers: 2

You know the right answer?

An investment has an installed cost of $534,800. The cash flows over the four-year life of the inves...

Questions

Arts, 14.05.2021 04:40

Spanish, 14.05.2021 04:40

Computers and Technology, 14.05.2021 04:40

Biology, 14.05.2021 04:50

Chemistry, 14.05.2021 04:50

Mathematics, 14.05.2021 04:50

Computers and Technology, 14.05.2021 04:50

Mathematics, 14.05.2021 04:50