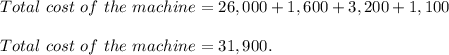

Whole Grain Bakery purchases an industrial bread machine for $26,000. In addition to the purchase price, the company makes the following expenditures: freight, $1,600; installation, $3,200; testing, $1,100; and property tax on the machine for the first year, $520. What is the initial cost of the bread machine?

Answers: 1

Another question on Business

Business, 21.06.2019 14:00

Take it all away has a cost of equity of 10.63 percent, a pretax cost of debt of 5.33 percent, and a tax rate of 35 percent. the company's capital structure consists of 71 percent debt on a book value basis, but debt is 31 percent of the company's value on a market value basis. what is the company's wacc?

Answers: 2

Business, 21.06.2019 22:50

Tara incorporates her sole proprietorship, transferring it to newly formed black corporation. the assets transferred have an adjusted basis of $240,000 and a fair market value of $300,000. also transferred was $10,000 in liabilities, $1,000 of which was personal and the balance of $9,000 being business related. in return for these transfers, tara receives all of the stock in black corporation. a. black corporation has a basis of $241,000 in the property. b. black corporation has a basis of $240,000 in the property. c. tara’s basis in the black corporation stock is $241,000. d. tara’s basis in the black corporation stock is $249,000. e. none of the above.

Answers: 1

Business, 22.06.2019 01:30

Ben collins plans to buy a house for $166,000. if the real estate in his area is expected to increase in value by 2 percent each year, what will its approximate value be five years from now?

Answers: 1

Business, 22.06.2019 03:00

Which of the following is not a consideration when determining your asset allocation

Answers: 3

You know the right answer?

Whole Grain Bakery purchases an industrial bread machine for $26,000. In addition to the purchase pr...

Questions

History, 11.03.2022 22:10

Geography, 11.03.2022 22:10

Social Studies, 11.03.2022 22:10

Mathematics, 11.03.2022 22:20

English, 11.03.2022 22:20

Business, 11.03.2022 22:20

History, 11.03.2022 22:20

English, 11.03.2022 22:20