Business, 24.03.2020 19:12 lacyfigueroa

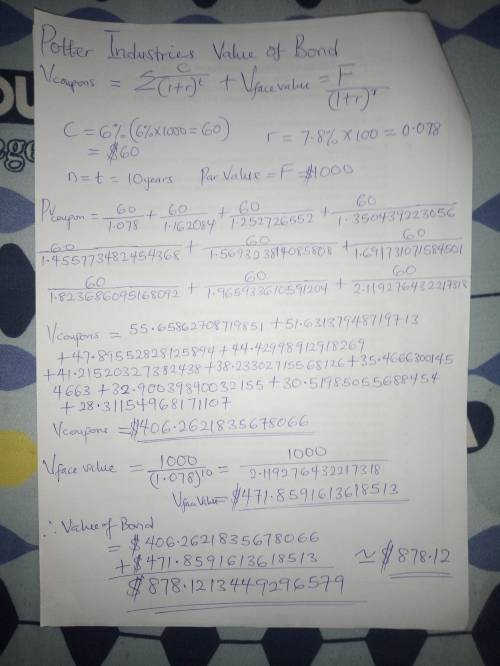

Quantitative Problem: Potter Industries has a bond issue outstanding with an annual coupon of 6% and a 10-year maturity. The par value of the bond is $1,000. If the going annual interest rate is 7.8%, what is the value of the bond? Do not round intermediate calculations. Round your answer to the nearest cent.

Answers: 3

Another question on Business

Business, 22.06.2019 21:00

There is just one person in our group, silvia, who seems to have radically different ideas about how to complete our project. she seems to purposely disagree with the majority opinions of the rest of us though yesterday she said something that made a lot of sense to us solve our production problem. i suggested to the entire group today that we hear silvia’s suggestions and asked silvia to share in-depth more of what she said yesterday. i am using which adaptive leader behavior?

Answers: 2

Business, 23.06.2019 01:30

Why would adjusting the money supply be expected to increase economic growth during a recession? a) increasing the money supply will encourage more saving. b) increased money supply will encourage more spending and investment. co) decreased money supply will encourage more spending and investment. d) recession is caused by too much

Answers: 3

Business, 23.06.2019 02:30

When the price of pencils increases from $1.50 to $2.50, there is an increase in quantity demanded of pens from 100 to 150. the cross-price elasticity of demand between pencils and pens is: ?

Answers: 3

Business, 23.06.2019 02:30

Organizations typically rely on schedules, such as hourly wages and annual reviews and raises.

Answers: 2

You know the right answer?

Quantitative Problem: Potter Industries has a bond issue outstanding with an annual coupon of 6% and...

Questions

Chemistry, 12.03.2021 01:30

English, 12.03.2021 01:30

Mathematics, 12.03.2021 01:30

Computers and Technology, 12.03.2021 01:30

Mathematics, 12.03.2021 01:30

Mathematics, 12.03.2021 01:30

English, 12.03.2021 01:30

Mathematics, 12.03.2021 01:30

Mathematics, 12.03.2021 01:30

Arts, 12.03.2021 01:30

Geography, 12.03.2021 01:30

Biology, 12.03.2021 01:30