$1,000 par value zero-coupon bonds (ignore liquidity premiums).

Bond Years to Maturity Y...

Business, 24.03.2020 02:49 mmimay3501

$1,000 par value zero-coupon bonds (ignore liquidity premiums).

Bond Years to Maturity Yield to Maturity

A 1 6.00%

B 2 7.50%

C 3 7.99%

D 4 8.49%

E 5 10.70%

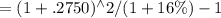

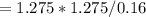

The expected 1-year interest rate 1 years from now should be

a. 6%

b. 7.5%

c. 9.02%

d. 10.70%

Answers: 3

Another question on Business

Business, 22.06.2019 07:10

In a team environment, a coordinator is? a person with expert knowledge or skills in a particular area the team needs. a good listener who works to resolve social problems among teammates. a leader who team members focus on their tasks. a good networker who likes to explore new ideas and possiblities.

Answers: 2

Business, 22.06.2019 17:30

What do you think: would it be more profitable to own 200 shares of penny’s pickles or 1 share of exxon? why do you think that?

Answers: 1

Business, 22.06.2019 18:00

Match the different financial task to their corresponding financial life cycle phases

Answers: 3

Business, 22.06.2019 18:30

Health insurance protects you if you experience any of the following except: a: if you have to be hospitalized b: if you damage someone's property c: if you need to visit a clinic d: if you can't work because of illness

Answers: 2

You know the right answer?

Questions

Mathematics, 13.06.2020 08:57

English, 13.06.2020 08:57

Social Studies, 13.06.2020 08:57

English, 13.06.2020 08:57