Business, 24.03.2020 02:24 strodersage

SkyChefs, Inc., prepares in-flight meals for a number of major airlines. One of the company’s products is grilled salmon in dill sauce with baby new potatoes and spring vegetables. During the most recent week, the company prepared 4,000 of these meals using 960 direct labor-hours. The company paid its direct labor workers a total of $19,200 for this work, or $20.00 per hour.

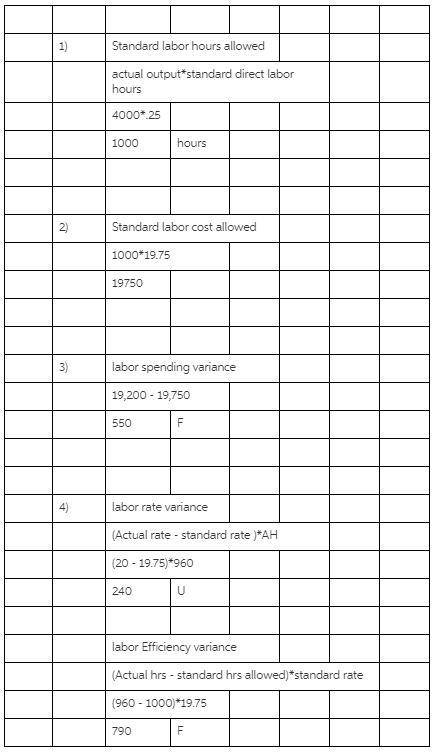

1. What is the standard labor-hours allowed (SH) to prepare 4,000 meals?

2. What is the standard labor cost allowed (SH x SR) to prepare 4,000 meals?

3. What is the labor spending variance?

4. What is the labor rate variance and the labor efficiency variance?

Answers: 2

Another question on Business

Business, 21.06.2019 13:50

Time value an iowa state savings bond can be converted to $750 at maturity 5 years from purchase. if the state bonds are to be competitive with u.s. savings bonds, which pay 5% annual interest (compounded annually), at what price must the state sell its bonds? assume no cash payments on savings bonds prior to redemption. ignore taxes.

Answers: 3

Business, 21.06.2019 22:50

The leading producer of cell phone backup batteries, jumpstart, has achieved great success because they produce high-quality battery backups that are not too expensive. even so, another company that produces lower-quality batteries at the same price has also achieved some success, but not as much as jumpstart. also, in general, the price of backup batteries has declined because of economies of scale and learning. in addition, jumpstart has added complementary assets, such as a carrying case. considering all of these factors, the backup battery industry is most likely in the introduction stage. growth stage. shakeout stage. maturity stage.

Answers: 2

Business, 22.06.2019 10:40

What would happen to the equilibrium price and quantity of lattés if the cost to produce steamed milk

Answers: 1

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

You know the right answer?

SkyChefs, Inc., prepares in-flight meals for a number of major airlines. One of the company’s produc...

Questions

Mathematics, 17.02.2021 20:50

Mathematics, 17.02.2021 20:50

Mathematics, 17.02.2021 20:50

English, 17.02.2021 20:50

Engineering, 17.02.2021 20:50

Mathematics, 17.02.2021 20:50

Mathematics, 17.02.2021 20:50

Mathematics, 17.02.2021 20:50

Mathematics, 17.02.2021 20:50

Mathematics, 17.02.2021 20:50

Computers and Technology, 17.02.2021 20:50

SAT, 17.02.2021 20:50

Mathematics, 17.02.2021 20:50

English, 17.02.2021 20:50