Consider three bonds with 6.80% coupon rates, all making annual coupon payments and all selling at face value. The short-term bond has a maturity of 4 years, the intermediate-term bond has a maturity of 8 years, and the long-term bond has a maturity of 30 years.

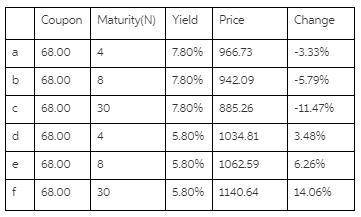

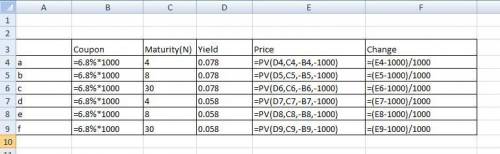

a. What will be the price of the 4-year bond if its yield increases to 7.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

b. What will be the price of the 8-year bond if its yield increases to 7.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

c. What will be the price of the 30-year bond if its yield increases to 7.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

d. What will be the price of the 4-year bond if its yield decreases to 5.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

e. What will be the price of the 8-year bond if its yield decreases to 5.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

f. What will be the price of the 30-year bond if its yield decreases to 5.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

g. Comparing your answers to parts (a), (b), and (c), are long-term bonds more or less affected than short-term bonds by a rise in interest rates?

More or less affected

h. Comparing your answers to parts (d), (e), and (f), are long-term bonds more or less affected than short-term bonds by a decline in interest rates?

More or less affected

Answers: 1

Another question on Business

Business, 22.06.2019 02:00

Precision dyes is analyzing two machines to determine which one it should purchase. the company requires a rate of return of 15 percent and uses straight-line depreciation to a zero book value over the life of its equipment. ignore bonus depreciation. machine a has a cost of $462,000, annual aftertax cash outflows of $46,200, and a four-year life. machine b costs $898,000, has annual aftertax cash outflows of $16,500, and has a seven-year life. whichever machine is purchased will be replaced at the end of its useful life. which machine should the company purchase and how much less is that machine's eac as compared to the other machine's

Answers: 3

Business, 22.06.2019 11:00

If the guide wprds on the page are "crochet " and "crossbones", which words would not be on the page. criticize, crocodile,croquet,crouch,crocus.

Answers: 1

Business, 22.06.2019 13:30

You operate a small advertising agency. you employ two secretaries, a graphic designer, three sales representatives, and an office coordinator. 1. what types of things would you consider when determining how to compensate each position? describe two (2) considerations. 2. what type of compensation plan would you use for each position?

Answers: 1

Business, 22.06.2019 20:00

How many organs are supplied at a zero price? (b) how many people die in the government-regulated economy where the government-set price ceiling is p = 0? the quantity qd – qa. the quantity qe – qa. the quantity qd – qe. (c) how many people die in the market-driven economy?

Answers: 1

You know the right answer?

Consider three bonds with 6.80% coupon rates, all making annual coupon payments and all selling at f...

Questions

Physics, 23.02.2021 14:00

Mathematics, 23.02.2021 14:00

World Languages, 23.02.2021 14:00

Mathematics, 23.02.2021 14:00

Mathematics, 23.02.2021 14:00

Mathematics, 23.02.2021 14:00

English, 23.02.2021 14:00

History, 23.02.2021 14:00

Mathematics, 23.02.2021 14:00

History, 23.02.2021 14:00

English, 23.02.2021 14:00