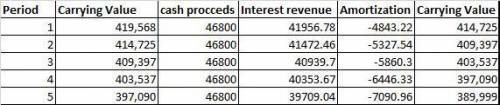

On January 1, 2020, Monty Company purchased 12% bonds having a maturity value of $390,000, for $419,567.77. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2020, and mature January 1, 2025, with interest received on January 1 of each year. Monty Company uses the effective-interest method to allocate unamortized discount or premium. The bonds are classified in the held-to-maturity category. Prepare the journal entry at the date of the bond purchase. Prepare a bond amortization schedule. Prepare the journal entry to record the interest revenue and the amortization at December 31.

Answers: 2

Another question on Business

Business, 21.06.2019 23:10

At the end of the current year, $59,500 of fees have been earned but have not been billed to clients. required: a. journalize the adjusting entry to record the accrued fees on december 31. refer to the chart of accounts for exact wording of account titles. b. if the cash basis rather than the accrual basis had been used, would an adjusting entry have been necessary?

Answers: 2

Business, 22.06.2019 03:10

Transactions that affect earnings do not necessarily affect cash. identify the effect, if any, that each of the following transactions would have upon cash and net income. the first transaction has been completed as an example. (if an amount reduces the account balance then enter with negative sign preceding the number e.g. -15,000 or parentheses e.g. (15, cash net income (a) purchased $120 of supplies for cash. –$120 $0 (b) recorded an adjustment to record use of $35 of the above supplies. (c) made sales of $1,370, all on account. (d) received $700 from customers in payment of their accounts. (e) purchased equipment for cash, $2,450. (f) recorded depreciation of building for period used, $740. click if you would like to show work for this question: open show work

Answers: 3

Business, 22.06.2019 16:40

Based on what you learned about time management which of these statements are true

Answers: 1

Business, 22.06.2019 16:40

Determine the hrm’s role in the performance management process and explain how to ensure the process aligns with the organization’s strategic plan.

Answers: 1

You know the right answer?

On January 1, 2020, Monty Company purchased 12% bonds having a maturity value of $390,000, for $419,...

Questions

Biology, 03.10.2019 02:30

Computers and Technology, 03.10.2019 02:30

Social Studies, 03.10.2019 02:30

Mathematics, 03.10.2019 02:30

English, 03.10.2019 02:30

Mathematics, 03.10.2019 02:30

Geography, 03.10.2019 02:30

Geography, 03.10.2019 02:30

Mathematics, 03.10.2019 02:30

Mathematics, 03.10.2019 02:30

![\left[\begin{array}{cccccc}#&$B.Carrying&$cash&$Interest&$Amortization&$E.Carrying\\1&419567.77&46800&41956.78&-4843.22&414724.55\\2&414724.55&46800&41472.46&-5327.54&409397.01\\3&409397.01&46800&40939.7&-5860.3&403536.71\\4&403536.71&46800&40353.67&-6446.33&397090.38\\5&397090.38&46800&39709.04&-7090.96&389999.42\\\end{array}\right]](/tpl/images/0559/5401/386bc.png)