Business, 20.03.2020 06:24 isabellesolisss5217

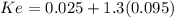

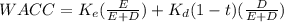

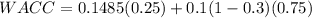

Vision Inc. is financed through both debt and equity, with a D/E ratio of 0.75. The firm’s overall risk is measured at a beta of 1.3 with a cost of equity of 12 percent. The risk-free rate of return is 2.5 percent and the tax rate is 30%. The company’s debt consists of semiannual bonds, with a coupon rate of 10%. They have 10 years to maturity and currently sell for $1,000.

Answers: 2

Another question on Business

Business, 22.06.2019 09:30

Any point on a country's production possibilities frontier represents a combination of two goods that an economy:

Answers: 3

Business, 22.06.2019 10:20

Asmartphone manufacturing company uses social media to achieve different business objectives. match each social media activity of the company to the objective it the company achieve.

Answers: 2

Business, 22.06.2019 10:30

When sending a claim to an insurance company for services provided by the physician, why are both icd-10 and cpt codes required to be submitted? how are these codes dependent upon each other? what would be the result of not submitting both codes on a medical claim to an insurance company?

Answers: 2

Business, 22.06.2019 22:50

Suppose that the u.s. dollars-mexican pesos exchange rate is fixed by the u.s. and mexican governments. assume also that labor is mobile between the united states and mexico due to low transportation costs.which of the following situations is likely to happen as a result of a simultaneous increase in the demand for u.s. goods and decrease in the demand for mexican goods? (pick mexican unemployment rate increases, and the country undergoes bad economic times for a sustained u.s. unemployment rate increases, and the country undergoes bad economic times for a sustained mexican unemployment rate rises at first, but it soon drops as unemployed mexicans move to the united states for mexican unemployment rate rises at first, but then it drops as mexican pesos depreciate against u.s. dollars.

Answers: 1

You know the right answer?

Vision Inc. is financed through both debt and equity, with a D/E ratio of 0.75. The firm’s overall r...

Questions

Mathematics, 21.11.2020 01:30

Mathematics, 21.11.2020 01:30

Mathematics, 21.11.2020 01:30

Social Studies, 21.11.2020 01:30

Chemistry, 21.11.2020 01:30

English, 21.11.2020 01:30

Advanced Placement (AP), 21.11.2020 01:30

Mathematics, 21.11.2020 01:30

History, 21.11.2020 01:30

History, 21.11.2020 01:30

English, 21.11.2020 01:30