Business, 20.03.2020 04:03 Svetakotok

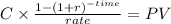

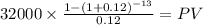

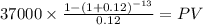

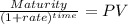

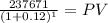

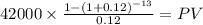

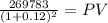

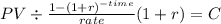

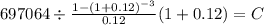

Three employees of the Horizon Distributing Company will receive annual pension payments from the company when they retire. The employees will receive their annual payments for as long as they live. Life expectancy for each employee is 13 years beyond retirement. Their names, the amount of their annual pension payments, and the date they will receive their first payment are shown below:Employee Annual Payment Date of First Payment Tinkers $ 32,000 12/31/21 Evers 37,000 12/31/22 Chance 42,000 12/31/23 Required: 1. Compute the present value of the pension obligation to these three employees as of December 31, 2021. Assume a 12% interest rate. 2. The company wants to have enough cash invested at December 31, 2024, to provide for all three employees. To accumulate enough cash, they will make three equal annual contributions to a fund that will earn 12% interest compounded annually. The first contribution will be made on December 31, 2021. Compute the amount of this required annual contribution.

Answers: 2

Another question on Business

Business, 21.06.2019 14:30

John f. kennedy believed that a leader should be elected successful a lifelong student in the military

Answers: 3

Business, 22.06.2019 13:20

Last year, johnson mills had annual revenue of $37,800, cost of goods sold of $23,200, and administrative expenses of $6,300. the firm paid $700 in dividends and had a tax rate of 35 percent. the firm added $2,810 to retained earnings. the firm had no long-term debt. what was the depreciation expense?

Answers: 2

Business, 22.06.2019 21:10

Skychefs, inc. prepares in-flight meals for a number of major airlines. one of the company's products is grilled salmon in dill sauce with baby new potatoes and spring vegetables. during the most recent week, the company prepared 4000 of these meals using 960 direct labor hours. the company paid these direct labor workers a total of $19,200 for this work, or $20.00 per hour. according to standard cost card for this meal, it should require 0.25 direct labour-hours at a cost of $19.75 per hour.1. what is the standard labor-hours allowed (sh) to prepare 4,000 meals? 2. what is the standard labor cost allowed (sh x sr) to prepare 4,000 meals? 3. what is the labor spending variance? 4. what is the labor rate variance and the labor efficiency variance?

Answers: 3

Business, 22.06.2019 22:40

Colorado rocky cookie company offers credit terms to its customers. at the end of 2018, accounts receivable totaled $715,000. the allowance method is used to account for uncollectible accounts. the allowance for uncollectible accounts had a credit balance of $50,000 at the beginning of 2018 and $30,000 in receivables were written off during the year as uncollectible. also, $3,000 in cash was received in december from a customer whose account previously had been written off. the company estimates bad debts by applying a percentage of 15% to accounts receivable at the end of the year. 1. prepare journal entries to record the write-off of receivables, the collection of $3,000 for previously written off receivables, and the year-end adjusting entry for bad debt expense.2. how would accounts receivable be shown in the 2018 year-end balance sheet?

Answers: 1

You know the right answer?

Three employees of the Horizon Distributing Company will receive annual pension payments from the co...

Questions

History, 30.09.2019 09:50

Mathematics, 30.09.2019 09:50

Mathematics, 30.09.2019 09:50

Biology, 30.09.2019 09:50

Physics, 30.09.2019 09:50

Mathematics, 30.09.2019 09:50

History, 30.09.2019 09:50

Mathematics, 30.09.2019 09:50

Mathematics, 30.09.2019 09:50

Mathematics, 30.09.2019 09:50

Biology, 30.09.2019 09:50

Mathematics, 30.09.2019 09:50