Business, 19.03.2020 21:41 portedon6626

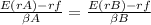

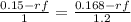

Assume both portfolios A and B are well diversified, that E(rA) = 15.0% and E(rB) = 16.8%. If the economy has only one factor, and βA = 1 while βB = 1.2, what must be the risk-free rate?

Answers: 3

Another question on Business

Business, 21.06.2019 18:30

Theodore is researching computer programming he thinks that this career has a great employment outlook so he’d like to learn if it’s a career in which he would excel what to skills are important for him to have and becoming a successful computer programmer

Answers: 3

Business, 22.06.2019 01:30

Juwana was turned down for a car loan by a local credit union she thought her credit was good what should her first step be

Answers: 1

Business, 22.06.2019 04:10

An outside manufacturer has offered to produce 60,000 daks and ship them directly to andretti's customers. if andretti company accepts this offer, the facilities that it uses to produce daks would be idle; however, fixed manufacturing overhead costs would be reduced by 75%. because the outside manufacturer would pay for all shipping costs, the variable selling expenses would be only two-thirds of their present amount. what is andretti's avoidable cost per unit that it should compare to the price quoted by the outside manufacturer?

Answers: 3

Business, 22.06.2019 06:00

Josie just bought her first fish tank a 36 -gallon glass aquarium, which she’s been saving up for almost a year to buy. for josie, the fish tank is most likely what type of purchase

Answers: 1

You know the right answer?

Assume both portfolios A and B are well diversified, that E(rA) = 15.0% and E(rB) = 16.8%. If the ec...

Questions

Mathematics, 13.04.2021 15:30

Mathematics, 13.04.2021 15:30

Business, 13.04.2021 15:30

History, 13.04.2021 15:30

Mathematics, 13.04.2021 15:30

Mathematics, 13.04.2021 15:30

Biology, 13.04.2021 15:30

Mathematics, 13.04.2021 15:30

Mathematics, 13.04.2021 15:30

History, 13.04.2021 15:30

Spanish, 13.04.2021 15:30

English, 13.04.2021 15:30