Business, 19.03.2020 05:43 beverly9662

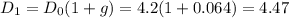

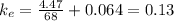

The Vogt corporation paid a dividend of $4.20 on its stock in the year just ended. If the dividends are projected to grow at a rate of 6.4% indefinitely, and the stock is presently selling for $68 a share, what is the estimated cost of equity for Vogt?

Answers: 2

Another question on Business

Business, 22.06.2019 10:00

Your uncle is considering investing in a new company that will produce high quality stereo speakers. the sales price would be set at 1.5 times the variable cost per unit; the variable cost per unit is estimated to be $75.00; and fixed costs are estimated at $1,200,000. what sales volume would be required to break even, i.e., to have ebit = zero?

Answers: 1

Business, 22.06.2019 11:00

When using various forms of promotion to carry the promotion message, it is important that the recipients of the message interpret it in the same way. creating a unified promotional message, where potential customers perceive the same message, whether it is in a tv commercial, or on a billboard, or in a blog, is called

Answers: 2

Business, 22.06.2019 11:00

%of the world's population controls approximately % of the world's finances (the sum of gross domestic products)" quizlket

Answers: 1

Business, 22.06.2019 14:50

One pound of material is required for each finished unit. the inventory of materials at the end of each month should equal 20% of the following month's production needs. purchases of raw materials for february would be budgeted to be:

Answers: 2

You know the right answer?

The Vogt corporation paid a dividend of $4.20 on its stock in the year just ended. If the dividends...

Questions

Mathematics, 29.01.2021 21:30

Mathematics, 29.01.2021 21:30

Mathematics, 29.01.2021 21:30

Mathematics, 29.01.2021 21:30

Mathematics, 29.01.2021 21:30

Mathematics, 29.01.2021 21:30

English, 29.01.2021 21:30

Mathematics, 29.01.2021 21:30

Chemistry, 29.01.2021 21:30

Mathematics, 29.01.2021 21:30

Mathematics, 29.01.2021 21:30