Business, 19.03.2020 02:38 flyingcerberus1408

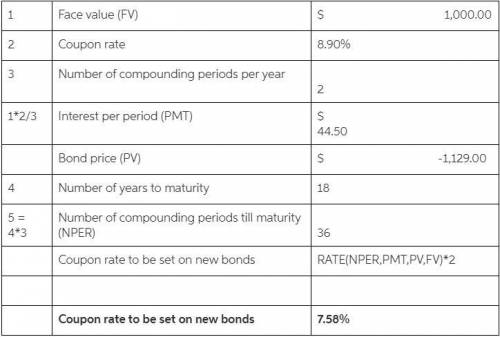

BDJ Co. wants to issue new 18-year bonds for some much-needed expansion projects. The company currently has 8.9 percent coupon bonds on the market that sell for $1,129, make semiannual payments, have a par value of $1,000, and mature in 18 years. What coupon rate should the company set on its new bonds if it wants them to sell at par

Answers: 3

Another question on Business

Business, 22.06.2019 03:10

Beswick company your team is allocated a project involving a major client, the beswick company. although the organization has many clients, this client, and project, is the largest source of revenue and affects the work of several other teams in the organization. the project requires continuous involvement with the client, so any problems with the client are immediately felt by others in the organization. jamie, a member of your team, is the only person in the company with whom this client is willing to deal. it can be said that jamie has:

Answers: 2

Business, 22.06.2019 11:00

When the federal reserve buys bonds from or sells bonds to member banks, it is called monetary policy reserve ratio interest rate adjustment open market operations

Answers: 1

Business, 22.06.2019 20:40

Cherokee inc. is a merchandiser that provided the following information: amount number of units sold 20,000 selling price per unit $ 30 variable selling expense per unit $ 4 variable administrative expense per unit $ 2 total fixed selling expense $ 40,000 total fixed administrative expense $ 30,000 beginning merchandise inventory $ 24,000 ending merchandise inventory $ 44,000 merchandise purchases $ 180,000 required: 1. prepare a traditional income statement. 2. prepare a contribution format income statement.

Answers: 2

Business, 22.06.2019 20:40

On january 1, 2017, pharoah company issued 10-year, $2,020,000 face value, 6% bonds, at par. each $1,000 bond is convertible into 16 shares of pharoah common stock. pharoah’s net income in 2017 was $317,000, and its tax rate was 40%. the company had 97,000 shares of common stock outstanding throughout 2017. none of the bonds were converted in 2017. (a) compute diluted earnings per share for 2017. (round answer to 2 decimal places, e.g. $2.55.) diluted earnings per share

Answers: 3

You know the right answer?

BDJ Co. wants to issue new 18-year bonds for some much-needed expansion projects. The company curren...

Questions

Mathematics, 01.03.2021 18:50

History, 01.03.2021 18:50

English, 01.03.2021 18:50

Mathematics, 01.03.2021 18:50

Mathematics, 01.03.2021 18:50

Mathematics, 01.03.2021 18:50

Chemistry, 01.03.2021 18:50

Mathematics, 01.03.2021 18:50

Mathematics, 01.03.2021 18:50

Mathematics, 01.03.2021 18:50

Medicine, 01.03.2021 18:50