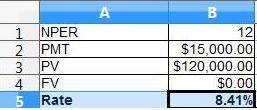

Assume that you own an investment that will pay you $15,000 per year for 12 years, with the first payment today. You need money today to start a new business, and your uncle offers to give you $120,000 for the investment. If you sell it, what rate of return would your uncle earn on the annuity?

Answers: 1

Another question on Business

Business, 22.06.2019 11:30

Mai and chuck have been divorced since 2012. they have three boys, ages 6, 8, and 10. all of the boys live with mai and she receives child support from chuck. mai and chuck both work and the boys need child care before and after school. te boys attend the fun house day care center and mai paid them $2,000 and chuck paid them $3,000. mai's agi is $18,000 and chuck's is $29,000. mai will claim two of the boys as dependents. she signed form 8332 which allows chuck to claim one of the boys. who can take the child and dependent care credit?

Answers: 3

Business, 22.06.2019 20:00

Double corporation acquired all of the common stock of simple company for

Answers: 1

Business, 22.06.2019 22:00

Miami incorporated estimates that its retained earnings break point (bpre) is $21 million, and its wacc is 13.40 percent if common equity comes from retained earnings. however, if the company issues new stock to raise new common equity, it estimates that its wacc will rise to 13.88 percent. the company is considering the following investment projects: project size irr a $4 million 14.00% b 5 million 15.10 c 4 million 16.20 d 6 million 14.20 e 1 million 13.42 f 6 million 13.75 what is the firm's optimal capital budget?

Answers: 3

You know the right answer?

Assume that you own an investment that will pay you $15,000 per year for 12 years, with the first pa...

Questions

Geography, 27.04.2020 02:18

Mathematics, 27.04.2020 02:18

English, 27.04.2020 02:18

English, 27.04.2020 02:18

Mathematics, 27.04.2020 02:18

English, 27.04.2020 02:18

Mathematics, 27.04.2020 02:18

Mathematics, 27.04.2020 02:18

Chemistry, 27.04.2020 02:18

Biology, 27.04.2020 02:18