Business, 18.03.2020 23:02 Hazeleyes13

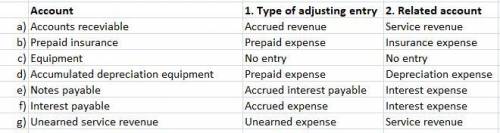

The trial balance of Woods Company includes the following balance sheet accounts. Identify the accounts that might require adjustment. For each account that requires adjustment, indicate (1) the type of adjusting entry and (2) the related account in the adjusting entry.

(a) Accounts Receivable

(b) Prepaid Insurance

(c) Equipment

(d) Accumulated Depreciation Equipment

(e) Notes Payable

(f) Interest Payable

(g) Unearned Service Revenue

Answers: 1

Another question on Business

Business, 22.06.2019 00:50

At a roundabout, you must yield to a. already in the roundaboutb. entering the roundaboutc. only if their turn signal is ond. only if they honk at you

Answers: 1

Business, 22.06.2019 03:30

Tiana daniels enterprise’s trial balance as at december 31, 2016 did not balance. on february 15, 2017 the following errors were detected: errorsi. water rates had been undercast by $2, 000. ii. a cheque paid to yvonne walch of $2, 680 had been posted to the credit side of her account. iii. discount received total of $1, 260 had been posted to the debit side of the discount allowed account as $1, 620. iv. rent paid in the amount of $24, 000 had been posted to the credit of the rent received account. v. wayne returned goods valuing $1, 680 to daniels enterprise but had been completely omitted from the books. required: 1. prepare the journal entries to correct the errors. (narrations required) 14.5 marks 2. prepare the suspense account showing clearly the original trial balance error. 8 marks

Answers: 2

Business, 22.06.2019 10:50

You are evaluating two different silicon wafer milling machines. the techron i costs $285,000, has a three-year life, and has pretax operating costs of $78,000 per year. the techron ii costs $495,000, has a five-year life, and has pretax operating costs of $45,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $55,000. if your tax rate is 24 percent and your discount rate is 11 percent, compute the eac for both machines.

Answers: 3

You know the right answer?

The trial balance of Woods Company includes the following balance sheet accounts. Identify the accou...

Questions

Biology, 18.10.2020 14:01

Mathematics, 18.10.2020 14:01

Mathematics, 18.10.2020 14:01

Mathematics, 18.10.2020 14:01

Mathematics, 18.10.2020 14:01

History, 18.10.2020 14:01

Arts, 18.10.2020 14:01

Biology, 18.10.2020 14:01

English, 18.10.2020 14:01

Physics, 18.10.2020 14:01

Mathematics, 18.10.2020 14:01