Business, 17.03.2020 06:19 Franky7035

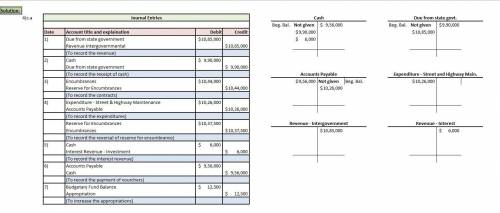

Special Revenue Fund Transactions Required: a. Record journal entries for the following transactions for FY 2014 and post to the general ledger. As there are relatively few revenues and expenditures, the use of control accounts is not necessary. (Make entries directly to individual revenue and expenditure accounts).

(1) The state government notified the City that $1,085,000 will be available for street and highway maintenance during 2014 (i. e. the City has met eligibility requirements). The funds are not considered reimbursement-type as defined by GASB standards.

(2) Cash in the total amount of $990,000 was received from the state government.

(3) Contracts, all eligible for payment from the Street and Highway Fund, were signed in the amount of $1,044,000.

(4) Contractual services (see transaction 3) were received; the related contracts amounted to $1,037,500. Invoices amounting to $1,026,000 for these items were approved for payment. The goods and services all were for street and highway maintenance.

(5) Investment revenue of $6,000 was earned and received.

(6) Vouchers were paid in the amount of $956,000.

(7) All required legal steps were accomplished to increase appropriations in the amount of $12,500.

b. Prepare and post the necessary closing entries for the Street and Highway Fund.

c. Prepare a Statement of Revenues, Expenditures, and Changes in Fund Balances for the Street and Highway Fund for the fiscal year ended December 31, 2014.

d. Prepare a Balance Sheet for the Street and Highway Fund as of December 31, 2014. Assume any unexpended net resources are classified as Restricted Fund Balance.

Answers: 3

Another question on Business

Business, 22.06.2019 12:50

You are working on a bid to build two city parks a year for the next three years. this project requires the purchase of $249,000 of equipment that will be depreciated using straight-line depreciation to a zero book value over the three-year project life. ignore bonus depreciation. the equipment can be sold at the end of the project for $115,000. you will also need $18.000 in net working capital for the duration of the project. the fixed costs will be $37000 a year and the variable costs will be $148,000 per park. your required rate of return is 14 percent and your tax rate is 21 percent. what is the minimal amount you should bid per park? (round your answer to the nearest $100) (a) $214,300 (b) $214,100 (c) $212,500 (d) $208,200 (e) $208,400

Answers: 3

Business, 22.06.2019 19:50

Right medical introduced a new implant that carries a five-year warranty against manufacturer’s defects. based on industry experience with similar product introductions, warranty costs are expected to approximate 2% of sales. sales were $8 million and actual warranty expenditures were $42,750 for the first year of selling the product. what amount (if any) should right report as a liability at the end of the year?

Answers: 2

Business, 22.06.2019 21:00

In a transportation minimization problem, the negative improvement index associated with a cell indicates that reallocating units to that cell would lower costs.truefalse

Answers: 1

Business, 22.06.2019 22:30

Selected information about income statement accounts for the reed company is presented below (the company's fiscal year ends on december 31): 2018 2017sales $ 4,400,000 $ 3,500,000cost of goods sold 2,860,000 2,000,000administrative expenses 800,000 675,000selling expenses 360,000 312,000interest revenue 150,000 140,000interest expense 200,000 200,000loss on sale of assets of discontinued component 50,000 —on july 1, 2018, the company adopted a plan to discontinue a division that qualifies as a component of an entity as defined by gaap. the assets of the component were sold on september 30, 2018, for $50,000 less than their book value. results of operations for the component (included in the above account balances) were as follows: 1/1/18-9/30/18 2017 sales $ 400,000 $ 500,000 cost of goods sold (290,000 ) (320,000 )administrative expenses (50,000 ) (40,000 )selling expenses (20,000 ) (30,000 )operating income before taxes $ 40,000 $ 110,000 in addition to the account balances above, several events occurred during 2018 that have not yet been reflected in the above accounts: a fire caused $50,000 in uninsured damages to the main office building. the fire was considered to be an infrequent but not unusual event.inventory that had cost $40,000 had become obsolete because a competitor introduced a better product. the inventory was sold as scrap for $5,000.income taxes have not yet been recorded.required: prepare a multiple-step income statement for the reed company for 2018, showing 2017 information in comparative format, including income taxes computed at 40% and eps disclosures assuming 300,000 shares of common stock. (amounts to be deducted should be indicated with a minus sign. round eps answers to 2 decimal places.)

Answers: 3

You know the right answer?

Special Revenue Fund Transactions Required: a. Record journal entries for the following transactions...

Questions

Mathematics, 20.11.2020 09:20

Mathematics, 20.11.2020 09:30

Chemistry, 20.11.2020 09:30

Mathematics, 20.11.2020 09:30

Engineering, 20.11.2020 09:30

Social Studies, 20.11.2020 09:30

Computers and Technology, 20.11.2020 09:30

History, 20.11.2020 09:30

Spanish, 20.11.2020 09:30

Mathematics, 20.11.2020 09:30

History, 20.11.2020 09:30

English, 20.11.2020 09:30