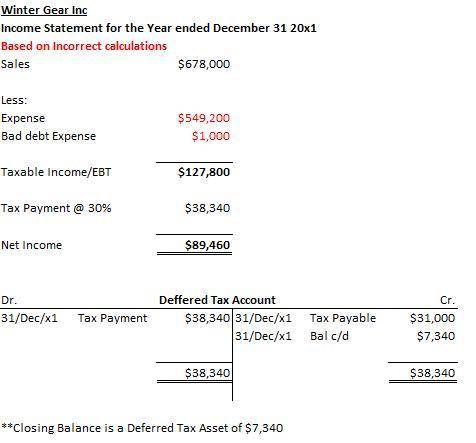

Winter Gear, Inc. business on January 1, 20X1. The company used the actual write-off of the receivable for the recorded bad debt expense in the below income statement. Credit sales $678,000 Bad debt expense as a percentage of sales 2% Write-off of accounts receivable $1,000 Tax rate 30% Estimated tax payment $31,000 Incorrect income statement, for the year ended December 31 Sales $678,000 Expenses 549,200 Bad debt expense 1,000 Pretax income 127,800 Tax expense 38,340 Net income 89,460 2) Assuming estimated tax payment of $31,000 what is taxes payable in 20X1? Taxes payable is a credit balance account, do not use brackets in your solution.

Answers: 1

Another question on Business

Business, 22.06.2019 20:30

Data for hermann corporation are shown below: per unit percent of sales selling price $ 125 100 % variable expenses 80 64 contribution margin $ 45 36 % fixed expenses are $85,000 per month and the company is selling 2,700 units per month. required: 1-a. how much will net operating income increase (decrease) per month if the monthly advertising budget increases by $9,000 and monthly sales increase by $20,000? 1-b. should the advertising budget be increased?

Answers: 1

Business, 22.06.2019 21:30

Which is cheaper: eating out or dining in? the mean cost of a flank steak, broccoli, and rice bought at the grocery store is $13.04 (money.msn website, november 7, 2012). a sample of 100 neighborhood restaurants showed a mean price of $12.75 and a standard deviation of $2 for a comparable restaurant meal. a. develop appropriate hypotheses for a test to determine whether the sample data support the conclusion that the mean cost of a restaurant meal is less than fixing a comparable meal at home. b. using the sample from the 100 restaurants, what is the p-value? c. at a = .05, what is your conclusion? d. repeat the preceding hypothesis test using the critical value approach

Answers: 3

Business, 23.06.2019 02:50

Kandon enterprises, inc., has two operating divisions; one manufactures machinery and the other breeds and sells horses. both divisions are considered separate components as defined by generally accepted accounting principles. the horse division has been unprofitable, and on november 15, 2018, kandon adopted a formal plan to sell the division. the sale was completed on april 30, 2019. at december 31, 2018, the component was considered held for sale. on december 31, 2018, the company’s fiscal year-end, the book value of the assets of the horse division was $415,000. on that date, the fair value of the assets, less costs to sell, was $350,000. the before-tax loss from operations of the division for the year was $290,000. the company’s effective tax rate is 40%. the after-tax income from continuing operations for 2018 was $550,000. required: 1. prepare a partial income statement for 2018 beginning with income from continuing operations. ignore eps disclosures. 2. prepare a partial income statement for 2018 beginning with income from continuing operations. assuming that the estimated net fair value of the horse division’s assets was $700,000, instead of $350,000. ignore eps disclosures.

Answers: 2

Business, 23.06.2019 13:10

Barry owns a 50 percent interest in b& b interests, a partnership. his brother, benny, owns a 35 percent interest in that same partnership, and the remaining 15 percent is owned by an unrelated individual. during 2016, barry sells a rental property with a basis of $60,000 to b& b interests for $100,000. the partnership intends to hold the rental as inventory for resale. what is the amount and nature of barry’s gain or loss on this transaction?

Answers: 1

You know the right answer?

Winter Gear, Inc. business on January 1, 20X1. The company used the actual write-off of the receivab...

Questions

Business, 14.02.2020 04:27

Mathematics, 14.02.2020 04:27

History, 14.02.2020 04:27

Computers and Technology, 14.02.2020 04:27

Mathematics, 14.02.2020 04:27

History, 14.02.2020 04:27

English, 14.02.2020 04:28

Mathematics, 14.02.2020 04:28

Mathematics, 14.02.2020 04:28