Business, 17.03.2020 05:22 goldenarrow

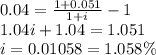

The outstanding bonds of Roxxon, Inc. provide an annual real rate of return of 4.0 percent. If the nominal rate of return is 5.1 percent, what is the inflation rate under the precise Fisher Effect? a.1.011 %b.1.100 %c.1.058 %d.9.304 % e.9.895 %

Answers: 1

Another question on Business

Business, 22.06.2019 09:50

For each of the following users of financial accounting information and managerial accounting information, specify whether the user would primarily use financial accounting information or managerial accounting information or both: 1. sec examiner 2. bookkeeping department 3. division controller 4. external auditor (public accounting firm) 5. loan officer at the company's bank 6. state tax agency auditor 7. board of directors 8. manager of the service department 9. wall street analyst 10. internal auditor 11. potential investors 12, current stockholders 13. reporter from the wall street journal 14. regional division managers

Answers: 1

Business, 22.06.2019 17:50

What additional information about the numbers used to compute this ratio might be useful in you assess liquidity? (select all that apply) (a) the maturity schedule of current liabilities (b) the average stock price for the industry (c) the average current ratio for the industry (d) the amount of current assets that is concentrated in relatively illiquid inventories

Answers: 3

Business, 22.06.2019 22:30

The answer here, x=7, is not in the interval that you selected in the previous part. what is wrong with the work shown above?

Answers: 1

You know the right answer?

The outstanding bonds of Roxxon, Inc. provide an annual real rate of return of 4.0 percent. If the n...

Questions

Mathematics, 05.10.2019 11:00

History, 05.10.2019 11:00

Mathematics, 05.10.2019 11:00

English, 05.10.2019 11:00

History, 05.10.2019 11:00

Social Studies, 05.10.2019 11:00

Physics, 05.10.2019 11:00