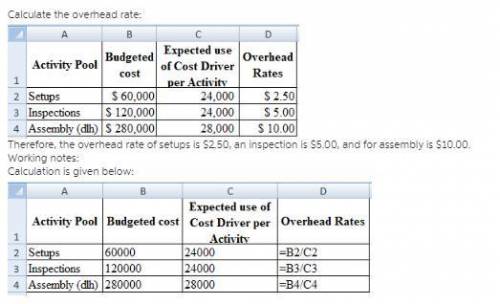

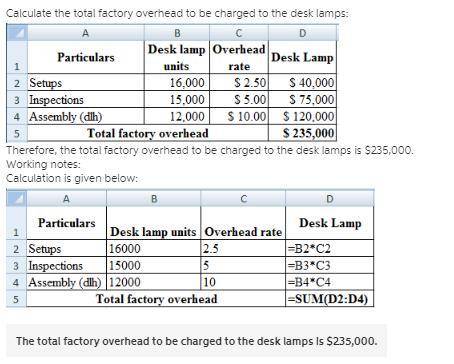

The Dawson Company manufactures small lamps and desk lamps. The following shows the activities per product and the total overhead information: Setups Inspections Assembly (dlh) Small Lamps - 4,700 units 4,000 8,850 40,800 Desk Lamps - 10,900 units 8,000 14,750 40,800 Activity Pool Activity Base Budgeted Amount Setups 12,000 $128,400 Inspections 23,600 $127,440 Assembly (dlh) 71,400 $285,600 Calculate the total factory overhead to be charged to desk lamps.

Answers: 2

Another question on Business

Business, 22.06.2019 07:00

Bridgeport company began operations at the beginning of 2018. the following information pertains to this company. 1. pretax financial income for 2018 is $115,000. 2. the tax rate enacted for 2018 and future years is 40%. 3. differences between the 2018 income statement and tax return are listed below: (a) warranty expense accrued for financial reporting purposes amounts to $7,500. warranty deductions per the tax return amount to $2,200. (b) gross profit on construction contracts using the percentage-of-completion method per books amounts to $94,700. gross profit on construction contracts for tax purposes amounts to $67,100. (c) depreciation of property, plant, and equipment for financial reporting purposes amounts to $61,800. depreciation of these assets amounts to $75,700 for the tax return. (d) a $3,600 fine paid for violation of pollution laws was deducted in computing pretax financial income. (e) interest revenue recognized on an investment in tax-exempt municipal bonds amounts to $1,500. 4. taxable income is expected for the next few years. (assume (a) is short-term in nature; assume (b) and (c) are long-term in nature.) (a) prepare the reconciliation schedule for 2017 and future years. (b) prepare the journal entry to record income tax expense for 2017. (c) prepare the income tax expense section of the income statement beginning with “income before income taxes.” (d) determine how the deferred taxes will appear on the balance sheet at the end of 2017.

Answers: 1

Business, 22.06.2019 15:40

Aprice control is: question 1 options: a)a tax on the sale of a good that controls the market price.b)an upper limit on the quantity of some good that can be bought or sold.c)a legal restriction on how high or low a price in a market may go.d)control of the price of a good by the firm that produces it.

Answers: 1

Business, 22.06.2019 18:00

Large public water and sewer companies often become monopolies because they benefit from although the company faces high start-up costs, the firm experiences average production costs as it expands and adds more customers. smaller competitors would experience average costs and would be less

Answers: 1

Business, 22.06.2019 19:40

Lauer corporation uses the periodic inventory system and has provided the following information about one of its laptop computers: date transaction number of units cost per unit 1/1 beginning inventory 210 $ 910 5/5 purchase 310 $ 1,010 8/10 purchase 410 $ 1,110 10/15 purchase 255 $ 1,160 during the year, lauer sold 1,025 laptop computers. what was cost of goods sold using the lifo cost flow assumption?

Answers: 1

You know the right answer?

The Dawson Company manufactures small lamps and desk lamps. The following shows the activities per p...

Questions

Business, 04.04.2020 18:03

Mathematics, 04.04.2020 18:04

Mathematics, 04.04.2020 18:04

Mathematics, 04.04.2020 18:04

Chemistry, 04.04.2020 18:04

Mathematics, 04.04.2020 18:04

English, 04.04.2020 18:04

Social Studies, 04.04.2020 18:05

Medicine, 04.04.2020 18:05

History, 04.04.2020 18:05

Mathematics, 04.04.2020 18:05

Mathematics, 04.04.2020 18:05

Health, 04.04.2020 18:05

Mathematics, 04.04.2020 18:05